The Capital Alliance (CAL) group has revamped its CALOnline platform, making it simpler than ever for Sri Lankans, particularly everyday investors, to access and invest in the stock market, government securities (treasuries), and unit trusts.

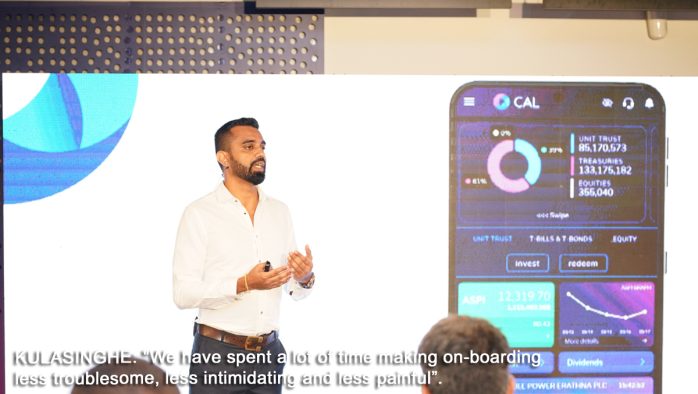

CAL, a diversified financial services group with expertise in stockbroking, treasury services, and fund management, has developed a user-friendly mobile app alongside the existing web platform. This “CalOnline 2.0” version is designed to streamline the onboarding process.

“We’ve invested significant effort into making signing up less intimidating and more user-friendly,” explained Tharindra Kulasinghe, CAL’s Chief Information Officer. Over 40,000 Sri Lankans have already used the platform for investment transactions.

CAL’s pioneering move to enable online applications for initial public offerings (IPOs) received a remarkable response from across the country. “We witnessed the app’s true potential when a significant number of subscribers participated from outside Colombo, highlighting the need for nationwide access,” Kulasinghe said.

Building on this success, CAL became the first (and currently the only) platform to offer online investment in Treasury bills and bonds. They are now working towards further lowering the minimum investment amount to Rs. 40,000 through LankaPay integration, making government securities more accessible to retail investors.

For stock market enthusiasts, CALOnline 2.0 offers valuable tools like a research platform and analytics. Additionally, a “dummy portfolio” feature allows new investors to simulate investment strategies and observe market movements before committing real capital.

“This allows first-time investors to observe performance for a period and gain an understanding of market fluctuations,” said Sachin Unamboowe, Head of Sales at CAL. Investors can also track macroeconomic data, individual stocks, and set price alerts.

Smaller transactions are facilitated through JustPay, providing real-time confirmation of fund transfers and enabling swift trade execution. Seylan Bank’s collaboration has been instrumental in integrating CALOnline with the banking system.

“Our aim is to allow seamless registration without human intervention, including KYC (Know Your Customer) processes,” explained Unamboowe. However, he clarified that investors are always welcome to contact CAL for assistance.

“CALOnline removes the hurdles for retail investors,” Unamboowe emphasized. “Anyone with a bank account, a mobile app, and an internet connection can now participate in the capital markets and potentially grow their wealth.”

The platform goes beyond investments, offering bill payment options for electricity and Dialog phone bills, with plans to expand to include more vendors in the future.

CALOnline 2.0 positions itself as a comprehensive ecosystem for Sri Lankans. It empowers them to access and learn about the country’s financial markets, invest strategically, and ultimately achieve their financial goals.