Sri Lanka’s central bank has absorbed Rs. 546 billion of domestic money out of the Rs. 578.5 billion created from foreign exchange purchases in the six months leading up to June 2024, according to official data.

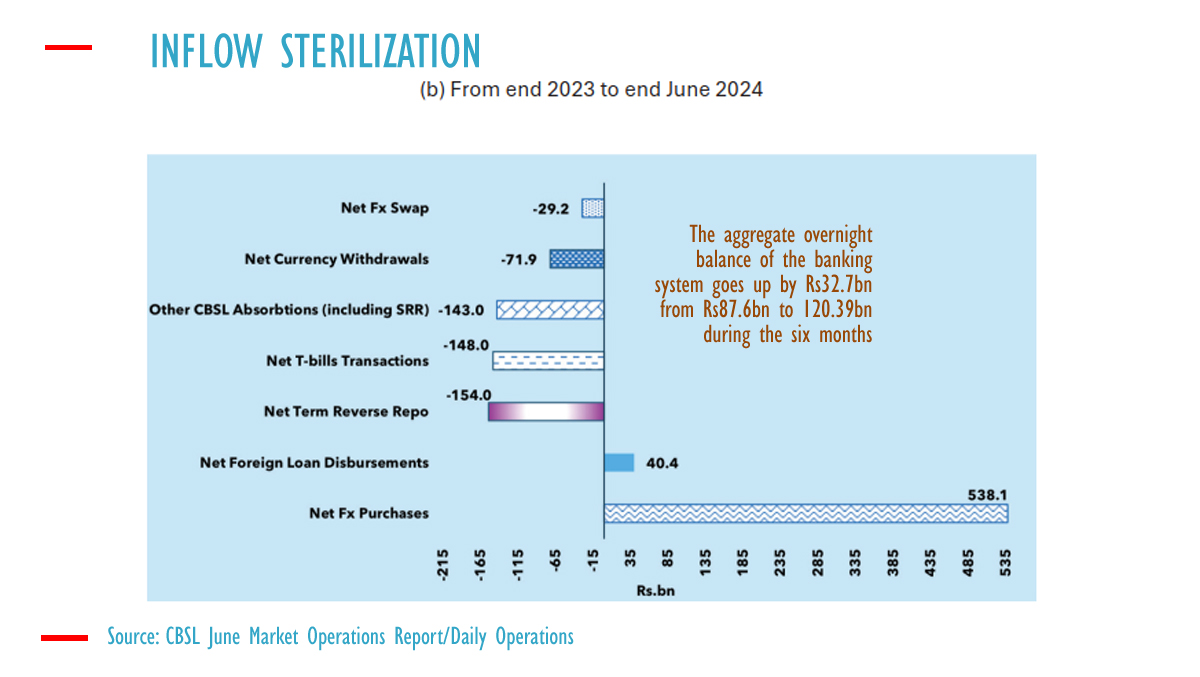

The central bank generated Rs. 538.1 billion from forex purchases and an additional Rs. 40.4 billion net from buying official foreign loan proceeds, after settling any related loans.

Analysts have noted that the central bank’s practices, including the surrender of Treasury dollar receipts, have exacerbated pressure on the rupee and driven up credit. This, they argue, necessitates further economic contraction to address the external crisis.

The central bank’s actions, such as selling Rs. 148 billion in Treasury bills from January to June 2024 and engaging in various liquidity operations, aimed to manage the generated rupees and bolster foreign reserves.

Despite these efforts, concerns persist about the potential for inflationary pressures and currency instability. Analysts highlight that continued printing of money through central bank tools, such as term or outright purchases of domestic securities, could impact inflation rates and currency stability.

In 2023, the central bank injected Rs. 1,129.6 billion through dollar purchases and domestic operations while withdrawing Rs. 810.9 billion through contractionary measures. The net effect has been a shift from a negative to a positive overnight aggregate balance in the interbank system.