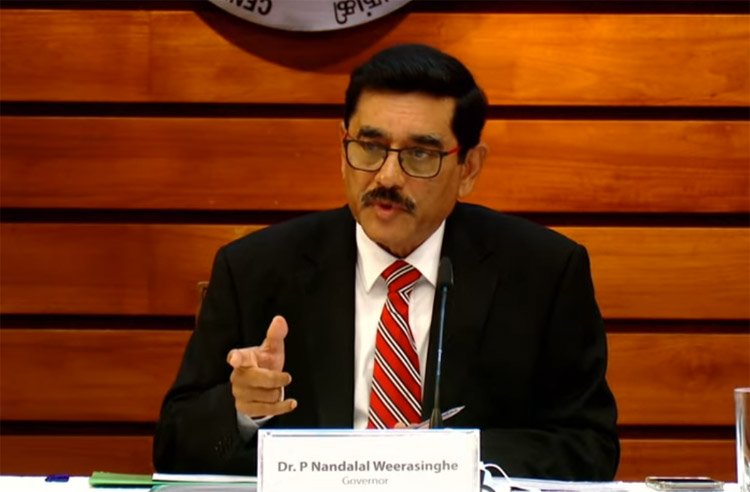

The Central Bank of Sri Lanka has expressed its readiness to support the government should it decide to ease restrictions on motor vehicle imports. This indication comes in light of Sri Lanka’s stable balance of payments and a current account surplus for the second consecutive year, according to Central Bank Governor Nandalal Weerasinghe in an interview with EconomyNext on October 26.

Governor Weerasinghe clarified that while the decision ultimately lies with the government and fiscal authorities, the Central Bank has conveyed its ability to handle the balance of payments if vehicle import restrictions are relaxed. “In terms of reserves and the balance of payments, we are in a favorable position,” he said. “Next year, even with vehicle imports, a small manageable deficit is expected, far below the levels of past deficits.”

As of September 2024, Sri Lanka’s gross foreign reserves stood at around USD 6 billion, bolstered in part by the People’s Bank of China swap arrangement, although certain restrictions apply on its usage.

Relaxing vehicle import restrictions could potentially increase private credit demand, which may exert pressure on interest rates. However, the move is also projected to significantly raise government revenue through taxes. Vehicle imports were initially banned during the COVID-19 crisis to protect the country’s reserves following rate cuts.

The Central Bank’s stance aligns with previous statements from government officials hinting at a gradual relaxation of vehicle import policies, signaling a shift toward balancing economic stability with fiscal growth opportunities.