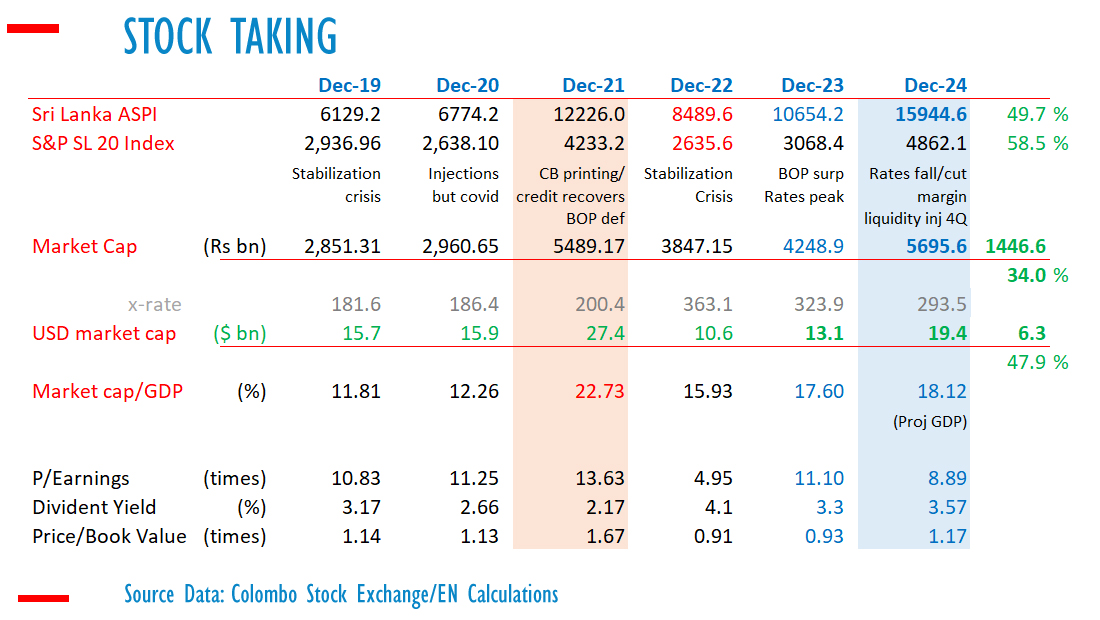

Sri Lanka stockholders were 1.4 trillion rupees wealthier by the end of 2024, with the dollar value of listed stocks increasing by 6.3 billion US dollars, according to year-end data analysis.

Colombo Stock Exchange data revealed that the market value of listed stocks stood at 5,695 billion rupees at the end of 2024, up by 1,446 billion rupees from the previous year. This value also includes new shares issued to raise capital during 2024.

Throughout the year, inflation remained largely absent, enabling consumer spending to recover and businesses to cut costs and retail prices. This stood in stark contrast to the inflation-driven economic theories of Anglophone macro-economists who view deflation negatively.

With falling interest rates, stocks surged in 2024, with margin-backed trading becoming more prevalent, analysts noted.

In 2021, after the central bank printed record amounts of money, stocks inflated rapidly, and the Colombo All Share Index rose by 80 percent to 12,226 points, fueled by a balance of payments crisis. However, stabilization policies deployed in 2022 led to a 30 percent drop in the Colombo All Share Index.

By the end of 2022, stock values had fallen to 3,847 billion rupees, down from 5,489 billion. The US dollar value of stocks also decreased to 10.6 billion from 27.4 billion the previous year. Despite higher kerb market rates compared to the official rate, stocks remained a hedge against inflation driven by aggressive central banking policies.

In 2024, the central bank allowed the rupee to appreciate under its deflationary policy, aiding in the recovery of losses, reducing commodity and energy prices, and restoring some of the purchasing power lost during the inflationary crisis of 2022.