The central bank of Sri Lanka has highlighted the country’s ongoing recovery from economic challenges amidst global risks, emphasizing the crucial role of the International Monetary Fund (IMF) program in maintaining confidence and stability. According to the Monetary Policy Report released in February, the continuation of the IMF Extended Fund Facility (EFF) arrangement and the implementation of structural reforms are pivotal factors shaping the economic outlook.

The report underscores the potential consequences of any disruption to the IMF program, warning of significant economic costs including growth setbacks, loss of investor confidence, and prolonged negative sentiments. Despite stabilization and signs of economic revival, the central bank acknowledges that growth may remain subdued in the near term.

Sri Lanka’s recent economic history has been tumultuous, marked by aggressive macroeconomic policies post-civil war that led to currency crises and escalated debt levels. Moreover, the global economic landscape presents additional challenges, with concerns over a potential slowdown exacerbated by actions such as the Federal Reserve’s monetary tightening.

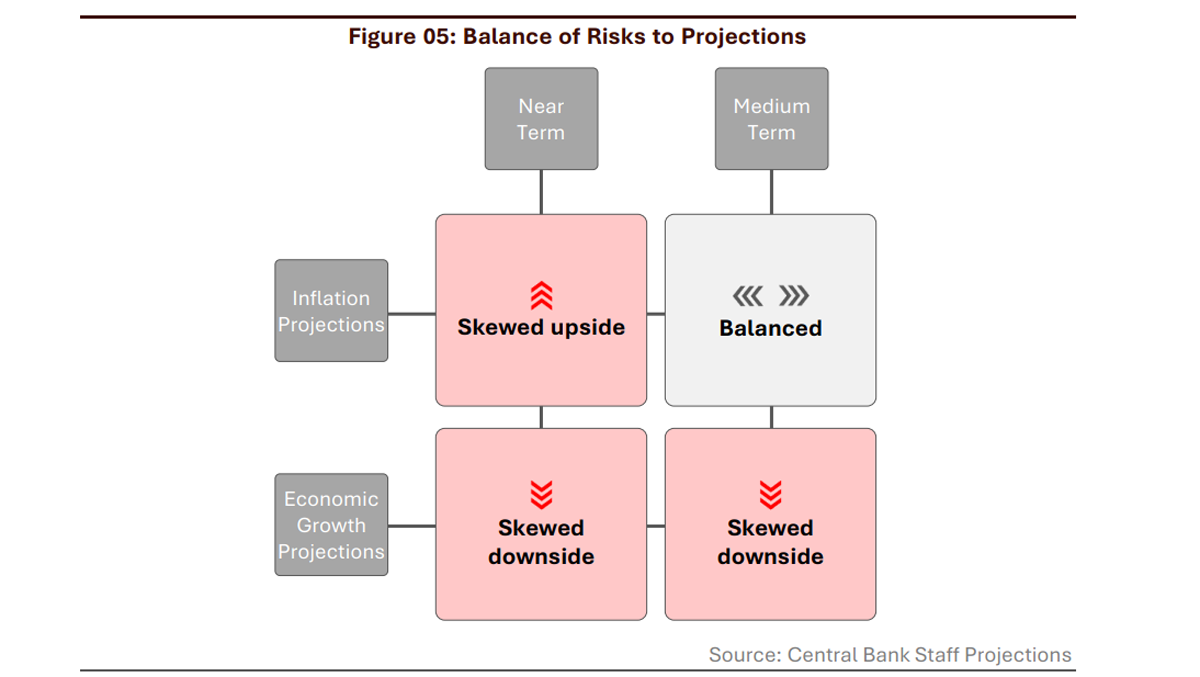

The central bank’s report suggests that economic growth is expected to gradually recover but remains susceptible to adverse global developments affecting export prospects. Additionally, structural impediments and skilled labour outmigration pose challenges to productivity and growth prospects.

In addressing these challenges, the central bank has pursued prudent monetary policies, allowing the exchange rate to appreciate amid deflationary measures. However, concerns persist regarding potential inflationary pressures, particularly with tax hikes on the horizon.

Overall, while Sri Lanka’s economic recovery is underway, uncertainties both domestically and globally underscore the importance of sustained policy measures and international support through initiatives like the IMF program.