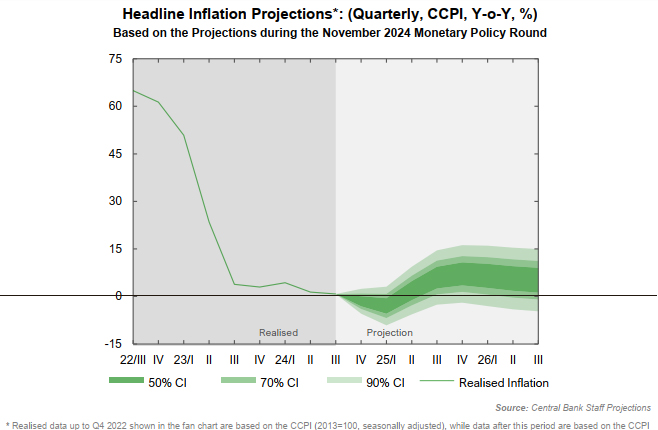

Sri Lanka’s central bank has stated that the country’s current low inflation is due to temporary “supply-side” factors and is expected to rise to around 5% by the third quarter of 2025. This follows two consecutive quarters of inflation below the target range of 5%, plus or minus 2%, with inflation recorded at 1.4% in Q2 and 0.8% in Q3 of 2024.

The central bank attributed the deviation from the target to substantial reductions in energy prices, particularly electricity, fuel, and LP gas, which led to lower-than-expected inflation. Furthermore, the Sri Lankan rupee’s 8.2% appreciation against the US dollar in the first nine months of 2024 helped reduce import prices and ease inflationary pressures.

Despite these favorable conditions, the central bank anticipates inflation will rise gradually, reaching target levels by Q3 2025 as the effects of supply-side factors dissipate and demand-side factors stabilize. While the country’s economic recovery has been strong, concerns about excessive liquidity injected into the economy in October have raised questions about future inflation trends.