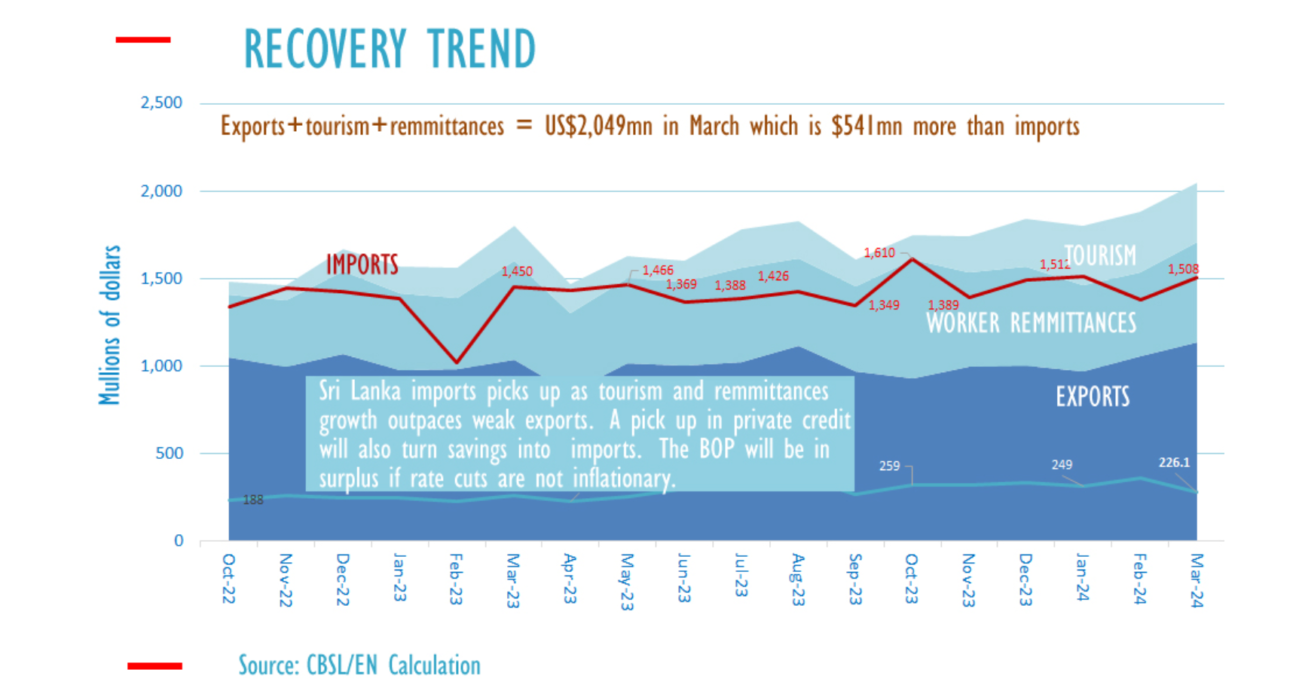

According to recent central bank data, Sri Lanka’s combined earnings from remittances, tourism, and exports reached $2.041 billion, surpassing imports by $514 million, which have also increased since March. Exports accounted for $1.139 billion, resulting in a merchandise trade deficit of $369 million. The country’s ability to sustain imports relies heavily on earning dollars through services such as tourism, overseas employment, and IT-BPO services.

The service account, excluding worker remittances, showed a surplus of $431 million. Notably, IT-BPO services contributed $70.4 million, while tourism revenue was estimated at $338.4 million, including both outbound travel by Sri Lankans and passenger transport out of the country. In the first quarter of 2024, the trade deficit rose to $1.229 billion from $896 million the previous year, while the service account surplus increased to $1.2675 billion from $782.5 million.

The balance of payments remained in surplus in March, reflecting inflows and outflows in the financial account and any discrepancies. To maintain this surplus and stabilize the exchange rate, the central bank may avoid printing money, opt for deflationary policies such as selling Treasury bills, and refrain from rate cuts or reverse repo injections.

However, adopting a fixed exchange rate with neutral policy, akin to East Asia’s approach, has led to a decline in domestic interest rates over time, achieved through reserve accumulation exceeding reserve money growth and maintaining higher rates than necessary for balance of payments equilibrium.