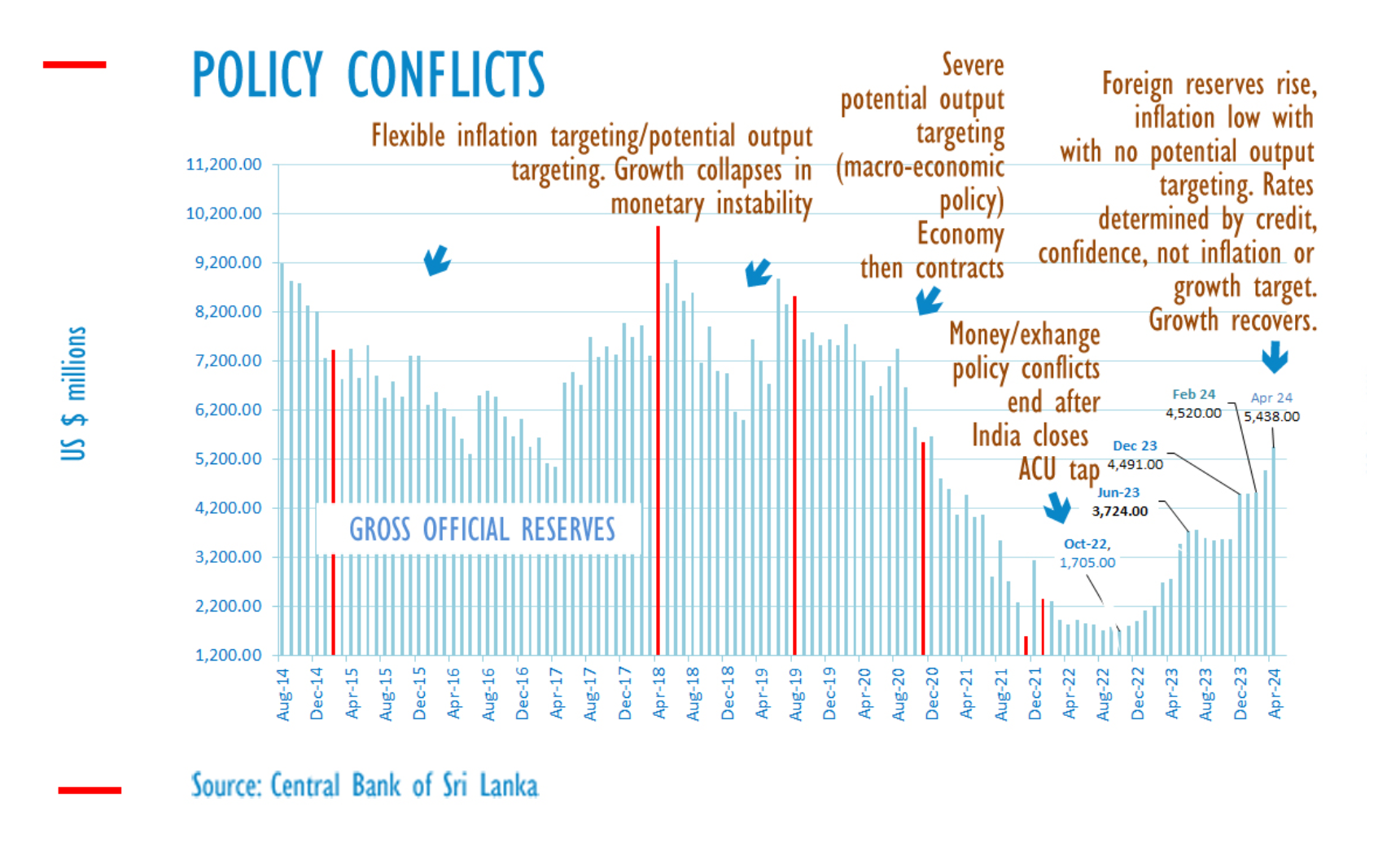

Sri Lanka’s gross official reserves experienced a significant increase in April 2024, reaching 5,438 million US dollars, according to official data, as the central bank continued its deflationary policy. This policy, involving net sell-downs of central bank-held domestic securities at market-appropriate interest rates, contributed to the development of a balance of payments surplus. The rupee appreciated sharply in March and early April, leading to delays in importer bills and substantial reserve collections.

Despite some pressure in the latter half of the month due to oversold positions, the central bank utilized moral suasion and dollar sales to stabilize the exchange rate. With private credit still weak, reserves could be collected easily, contributing to the stability of the external sector. Additionally, efforts to settle other loans, including those to the IMF and India, have improved the net foreign assets position of the monetary authority and the overall net international reserve position.

Analysts note that while the current policy has provided monetary stability and facilitated economic recovery, steep short-term currency appreciations may lead to speculative behavior and importer cover delays. Sri Lanka’s external sector has historically faced challenges post-war whenever rates are cut with inflationary policy, indicating the importance of maintaining a balanced approach to monetary policy. As May approaches, past trends suggest potential currency pressure following April’s excess liquidity.