In a bid to bolster its foreign exchange reserves, Sri Lanka’s central bank made significant purchases totalling $113 million from forex markets in December 2023, bringing the annual total to $1.895 billion, as per official data.

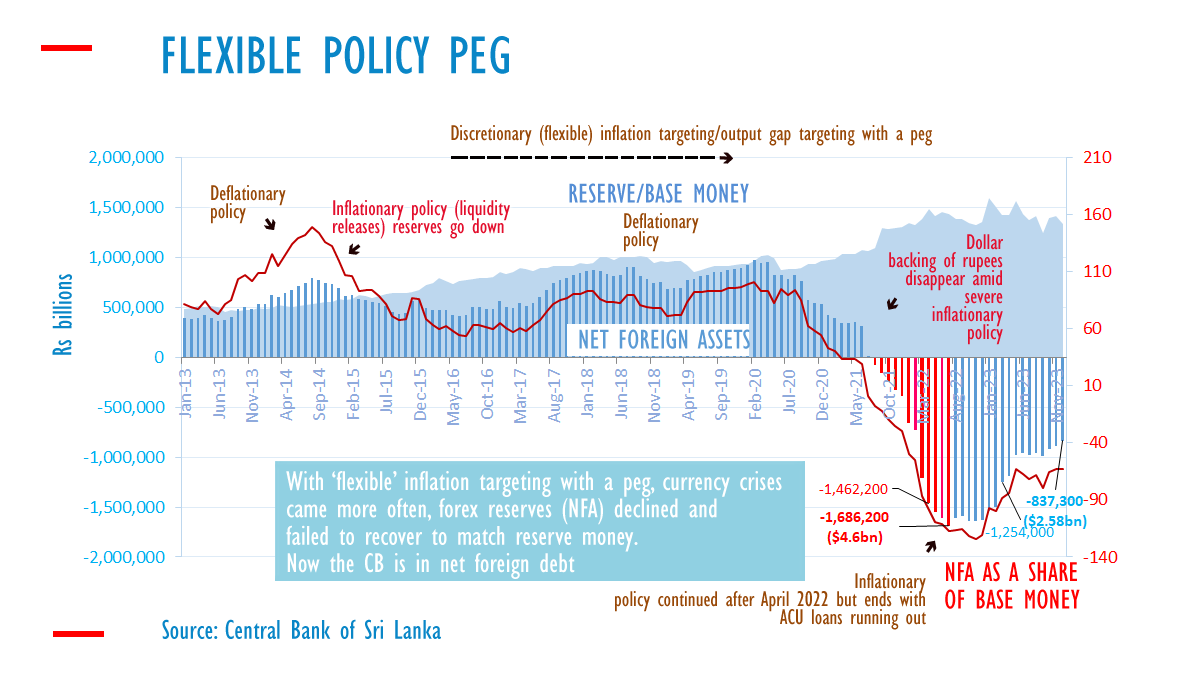

This accumulation of reserves was facilitated by the central bank’s deflationary policies, aimed at stabilizing the country’s monetary system amidst economic challenges. Notably, Sri Lanka faced a balance of payments crisis triggered by aggressive rate cuts and liquidity injections, prompting a series of corrective measures.

After a period of monetary instability, characterized by credit downgrades and economic contraction, Sri Lanka’s central bank managed to restore stability around August/September 2023. Subsequently, it began purchasing dollars and absorbing excess liquidity to strengthen its reserves.

This move was supported by limiting banks’ access to central bank funds through standing facilities, and curbing the practice of excessive reliance on central bank windows. However, critics argue that Sri Lanka’s monetary policies have historically incentivized overtrading, exacerbating forex shortages and instability.

Recent developments include the lifting of counterparty limits by the central bank, signalling a potential easing of the worst currency crisis witnessed in decades. Despite the reserve accumulation, the economy has shown signs of recovery, with interest rates declining and the exchange rate appreciating.

As Sri Lanka enters the first year of an IMF program, the exchange rate faces upward pressure, allowing for appreciation. However, concerns linger regarding the central bank’s transition to inflationary policies, which could reignite forex shortages and undermine stability.

Critics also caution against the IMF’s influence on Sri Lanka’s monetary policies, highlighting the risks associated with adopting Western-style liquidity operations in a reserve-collecting central bank.

Overall, while Sri Lanka’s central bank has made strides in bolstering reserves and stabilizing the currency, challenges remain in navigating the delicate balance between inflationary and deflationary policies to ensure long-term economic stability.