Pan Asia Banking Corporation PLC has announced a notable increase in its Profit before Tax (PBT) by 47% for the first quarter of 2024, reflecting improved macro-economic conditions. The bank’s financial performance during this period showcased prudent portfolio management strategies, especially in dealing with potential fallout on asset quality amidst challenging times.

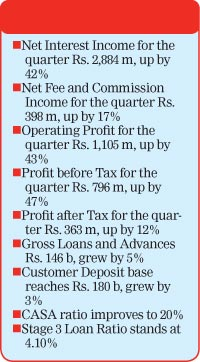

The bank reported a Pre-tax Profit of Rs. 796 million for the quarter ended 31 March 2024, a substantial increase compared to the corresponding quarter last year. This growth was supported by improvements in net interest income, net fee and commission income, and other operating income.

The positive performance aligns with signs of gradual economic recovery and stability in Sri Lanka’s macro-economic factors. Factors such as the appreciation of LKR against USD and measures like the IMF bailout and Domestic Debt Optimisation (DDO) have contributed to this positive trend.

The bank’s strategic models for collective impairment and allowance for overlays, initiated in 2023, were continued in 1Q 2024 to ensure sufficient provision buffers for potential credit risks. The bank also saw improvements in credit quality metrics due to enhanced credit underwriting standards and focused collection efforts.

Moreover, the bank’s net fee and commission income increased by 17%, primarily driven by higher fee income from loans and advances amid a low-interest rate environment. Other operating income saw a significant surge of 293% due to prudent FX position management with the appreciation of LKR against USD.

Despite increases in personnel expenses and other operating expenses, the bank’s Profit after Tax (PAT) for 1Q 2024 showed a 12% increase compared to the same period last year. The bank maintained robust capital and liquidity ratios well above regulatory standards, demonstrating its strong financial position.

Pan Asia Bank’s Director and CEO, Naleen Edirisinghe, expressed satisfaction with the bank’s performance, highlighting a nearly 50% growth in PBT for 1Q 2024. He emphasized the bank’s strategic focus on core banking and operational efficiencies, supported by digital enhancements and teamwork, as key drivers of this encouraging performance.