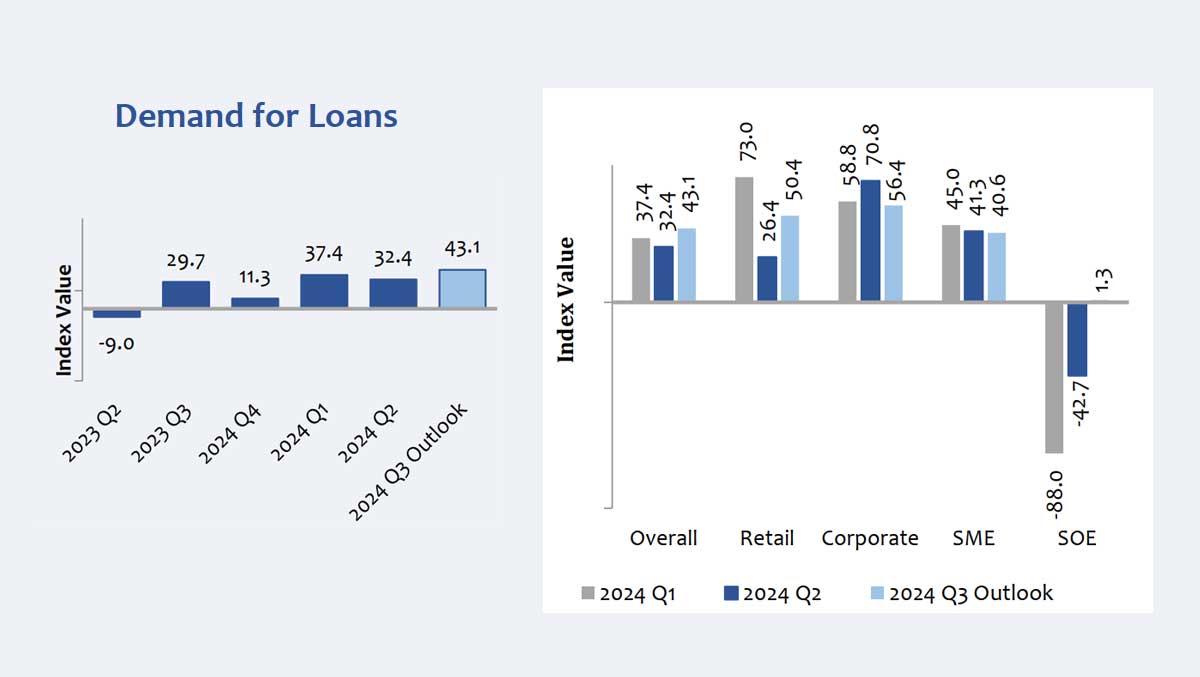

Sri Lanka experienced a significant increase in loan demand across the retail, corporate, and small and medium enterprise (SME) sectors during the second quarter of 2024, according to a recent survey by the Central Bank of Sri Lanka. This uptick is attributed to lower interest rates and stable exchange rates, reflecting improved economic confidence and a conducive business environment.

The Central Bank noted that while most sectors showed increased borrowing, demand from state-owned enterprises (SOEs) declined during this period. The positive trend is expected to continue into the third quarter, with projections indicating further growth in loan demand across various sectors.

“Reduced interest rates, economic growth, improvements in the business environment, relatively stable exchange rates, and expansions in economic activities mainly contributed to the observed increase in demand,” the Central Bank stated.

Looking ahead to the third quarter of 2024, the anticipated drivers for continued growth in loan demand include expected further reductions in interest rates, consistent policy measures, ongoing economic expansion, and recovery in key sectors. Notably, an increase in borrowing from SOEs is expected due to new projects focused on sustainable and renewable energy.

Since late 2022, the Central Bank has successfully maintained monetary stability, keeping the exchange rate steady and inflation around 2%. This stability has provided individuals and businesses the opportunity to recover and rebuild their economic standing after previous periods of volatility.

Historically, aggressive rate cuts and excessive liquidity injections have led to currency crises and economic instability, resulting in high interest rates and reduced consumer demand. However, the current prudent monetary policies have helped avert such scenarios, promoting a stable financial environment conducive to sustained economic growth and healthy credit expansion.

(Colombo/Aug 21, 2024)