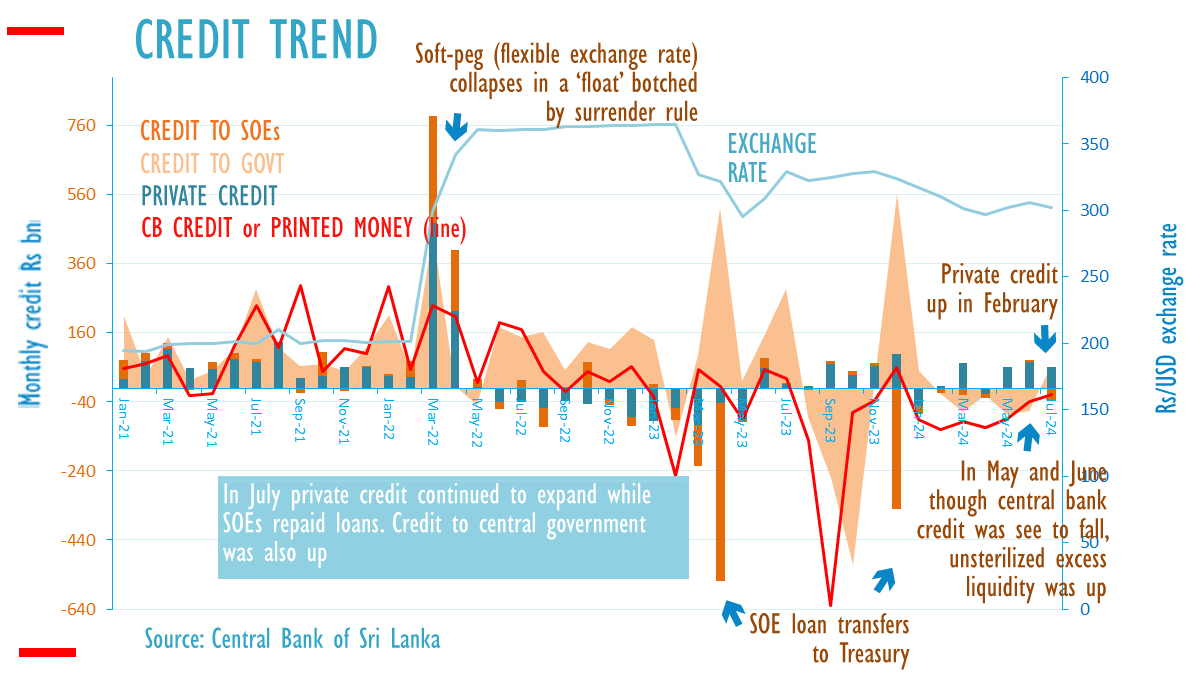

Sri Lanka’s private sector credit expanded by Rs. 60 billion in July 2024, following a Rs. 74 billion rise in June, according to official data. Meanwhile, credit to state-owned enterprises (SOEs) decreased during the same period.

In July, banks extended Rs. 82.7 billion in loans to the government, with much of this being interest roll-overs, essentially paper transactions outside of central bank credit. The central bank’s credit to the government recorded a negative figure of Rs. 19.8 billion, resulting in overall credit from the banking system to the government reaching Rs. 62.9 billion.

Earlier in May and June 2024, central bank credit saw a steep decline, but unsterilized excess liquidity from dollar purchases continued to exert pressure on the rupee, especially as it was converted into credit.

Macroeconomic impacts such as currency pressure are often driven by money printing to suppress interbank call rates or the central bank’s decision to leave excess liquidity from dollar purchases in the system, rather than taking action to stabilize the rupee through intervention.

The private sector in Sri Lanka, being a net saver, does not directly pressure the rupee. Instead, public savings are channeled into investment credit and imports through the banking system, contributing to the external sector.

Since September 2022, the central bank has adopted a broadly deflationary policy at appropriate interest rates, helping maintain a balance of payments surplus. SOEs, particularly energy companies, have been repaying debt with cost-based electricity and fuel sales, despite the underpricing of kerosene.