Japanese firms operating in Sri Lanka have expressed major concerns over political and social instability, unclear government policy management, and currency volatility, according to a recent survey by the Japan External Trade Organization (JETRO).

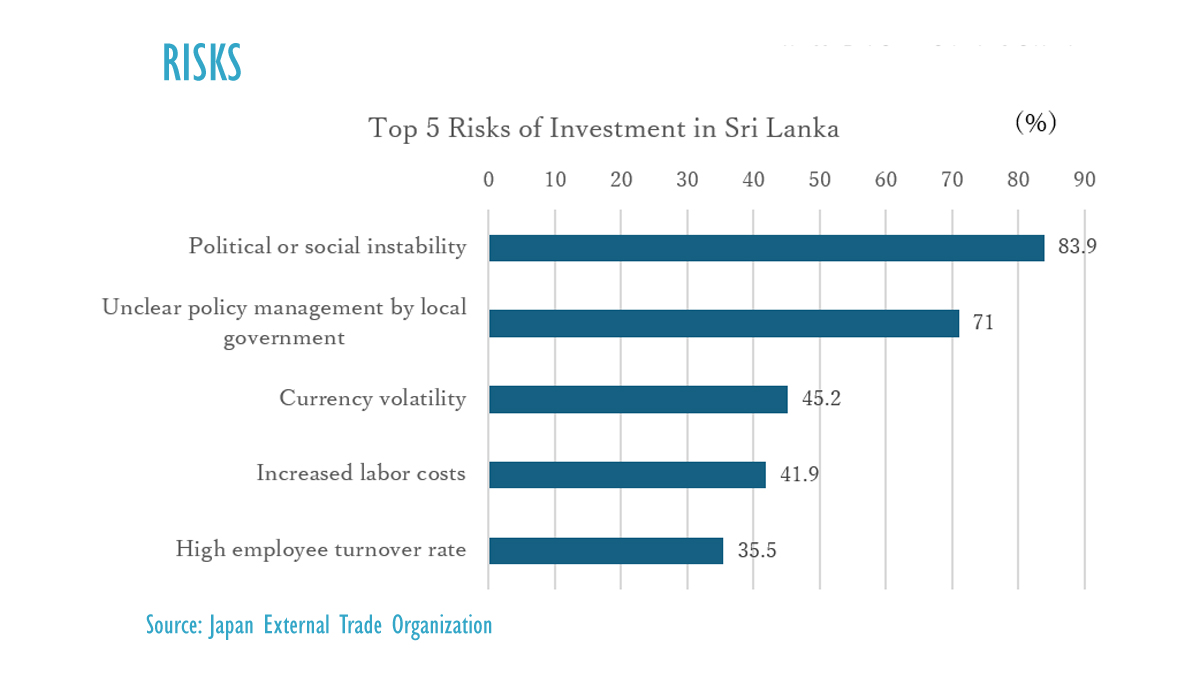

The survey revealed that 83.9% of Japanese firms cited political or social instability as the top risk to investment, followed by 71% pointing to unclear policy management and 45.2% highlighting currency volatility. Other concerns included rising labor costs (41.9%) and high employee turnover (35.5%).

Companies specifically noted challenges such as sudden import restrictions, abrupt tax rate changes, higher corporate taxes and utility tariffs, and the migration of young talent. Additional issues included power outages, long wait times for import licenses and residence visas, and supply chain risks due to import restrictions.

Sri Lanka has faced multiple currency crises since 2011, exacerbated by the central bank’s monetary policies. Import controls, a key issue for Japanese auto firms, were eventually lifted in 2022, but concerns remain over economic stability and policy direction.

Despite these challenges, Japanese firms still recognize Sri Lanka’s advantages, particularly low labor costs (54.8%), which are competitive with countries like Myanmar and Bangladesh. Other favorable factors include good communication standards (41.9%), market growth potential (38.7%), and tax incentives (22.6%).