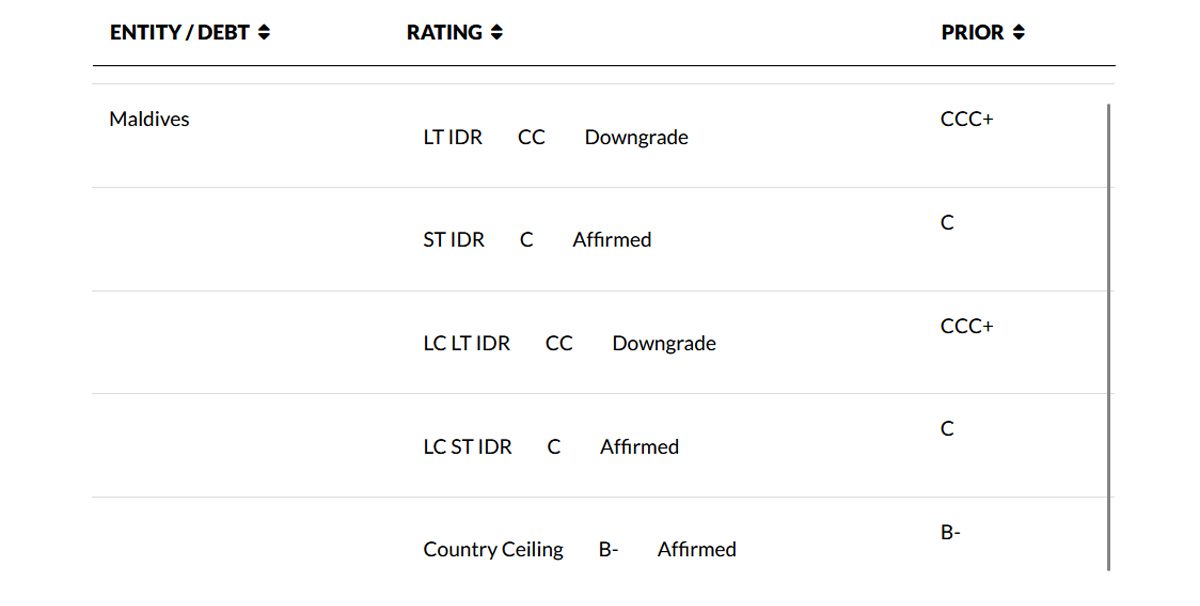

Fitch Ratings has downgraded the Maldives’ credit rating from CCC+ to CC, citing a decline in foreign reserves and the upcoming repayment of foreign debt and sukuk bonds starting next year.

As of July, the country’s gross foreign reserves had fallen to 395 million USD, down from 492 million USD earlier. Domestic reports highlight growing private credit, including personal loans refinanced with Covid-era money printing, which has led to foreign exchange shortages.

To address the liquidity surplus, experts suggest the Maldives Monetary Authority should permanently absorb excess liquidity by selling securities at higher market rates. Without such action, reserves may continue to decline as liquidity is redeemed in forex markets.

The Bank of Maldives recently introduced credit card limits on foreign exchange transactions, similar to Sri Lanka’s approach, but the Maldives Monetary Authority reversed the decision. Reports indicate that the banking system is burdened with 6.7 billion rufiyaa of excess liquidity, fueling a rise in personal loans and exacerbating credit expansion.

Fitch warns that unless interest rates are allowed to rise, the Maldives may face a currency crisis, as seen in other countries post-pandemic. Analysts predict that this could lead to a break in the soft-peg of the Maldivian rufiyaa, causing social and political unrest along with the risk of default.

The Maldives faces significant external debt obligations, with 64 million USD of government foreign debt and an additional 64 million USD of publicly guaranteed debt due in the fourth quarter of 2025. Moreover, 557 million USD in external debt servicing is due in 2025, and a 500 million USD Islamic bond (Sukuk) will mature in 2026.

Fitch notes that foreign exchange swap arrangements with strategic bilateral partners could help ease external financing pressures, though it remains uncertain if such agreements will materialize.

Central bank swaps, originally introduced by the U.S. Federal Reserve in the 1960s, were used to delay interest rate hikes. However, these strategies contributed to the collapse of the Bretton Woods system and resulted in high inflation globally. Analysts warn that if the Maldives continues to suppress interest rates while increasing credit through open market operations, it could face similar long-term economic consequences.