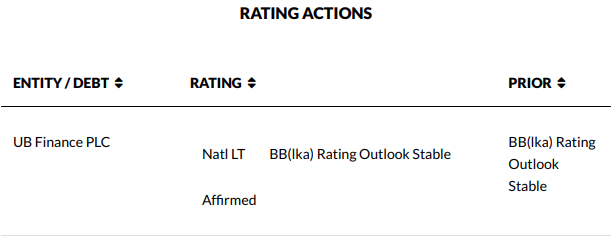

Fitch Ratings has affirmed UB Finance PLC’s National Long-Term Rating at ‘BB(lka)’ with a stable outlook. The rating reflects expectations of strong support from Union Bank of Colombo PLC (UB), which owns a significant stake in UB Finance. However, the rating is tempered by UB Finance’s relative size and its limited importance within the UB group, as its assets represent a modest portion of UB’s overall consolidated assets.

UB Finance’s intrinsic credit profile is considered weaker due to its small market share and high risk appetite, contributing to poor asset quality and thin capital buffers. The company’s planned rights issue aims to address regulatory capital shortfalls, but challenges remain regarding meeting regulatory requirements and sustaining growth while managing debt levels.

The rating is sensitive to changes in UB’s credit profile and its ability to extend timely support to UB Finance. Negative factors could include a notable decline in capital buffers, weak performance affecting parent support, or delays in financial assistance. Conversely, positive rating action would likely follow improvements in UB’s ability to support UB Finance and an increase in the subsidiary’s strategic importance within the UB group.