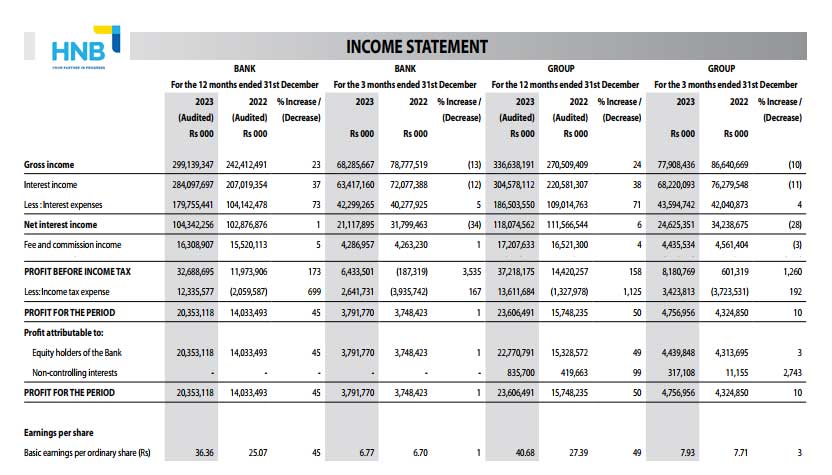

The Hatton National Bank (HNB) group in Sri Lanka, inclusive of its insurance unit, has reported a 3% rise in profits, reaching 4.43 billion rupees, according to interim accounts. This growth comes as a result of decreased provisions, compensating for a decline in net interest income.

In the December quarter, the HNB group achieved earnings of 7.93 rupees per share. For the entire year leading up to December, earnings stood at 40.68 rupees, marking a notable increase of 49% from the previous year, with total profits reaching 22.7 billion rupees.

Despite a 1% decrease in net fee and commission income, the group witnessed a negative trading gain of 1.9 billion rupees. Interest income at the bank level fell by 12% to 63.4 billion rupees, while interest expenses rose by 5% to 42.29 billion rupees, resulting in a 34% decline in interest income.

Throughout the year, loans contracted by 2% to 954 billion rupees, while impairment charges decreased significantly to 8.2 billion rupees from 30.1 billion rupees in the previous year. The stage 3 impaired loan ratio stood at 3.76%.

The bond portfolio experienced a notable 23% increase, reaching 549 billion rupees by December’s end. Meanwhile, group assets grew by 14%, totalling 2.04 billion rupees, with group net assets rising by 16% to 219 billion rupees.

At the bank level, equity surged by 16% to 184 billion rupees, with Tier 1 capital reaching 13.66%, up from 11.06%, and total capital adequacy standing at 17.13%, compared to 14.0% previously.