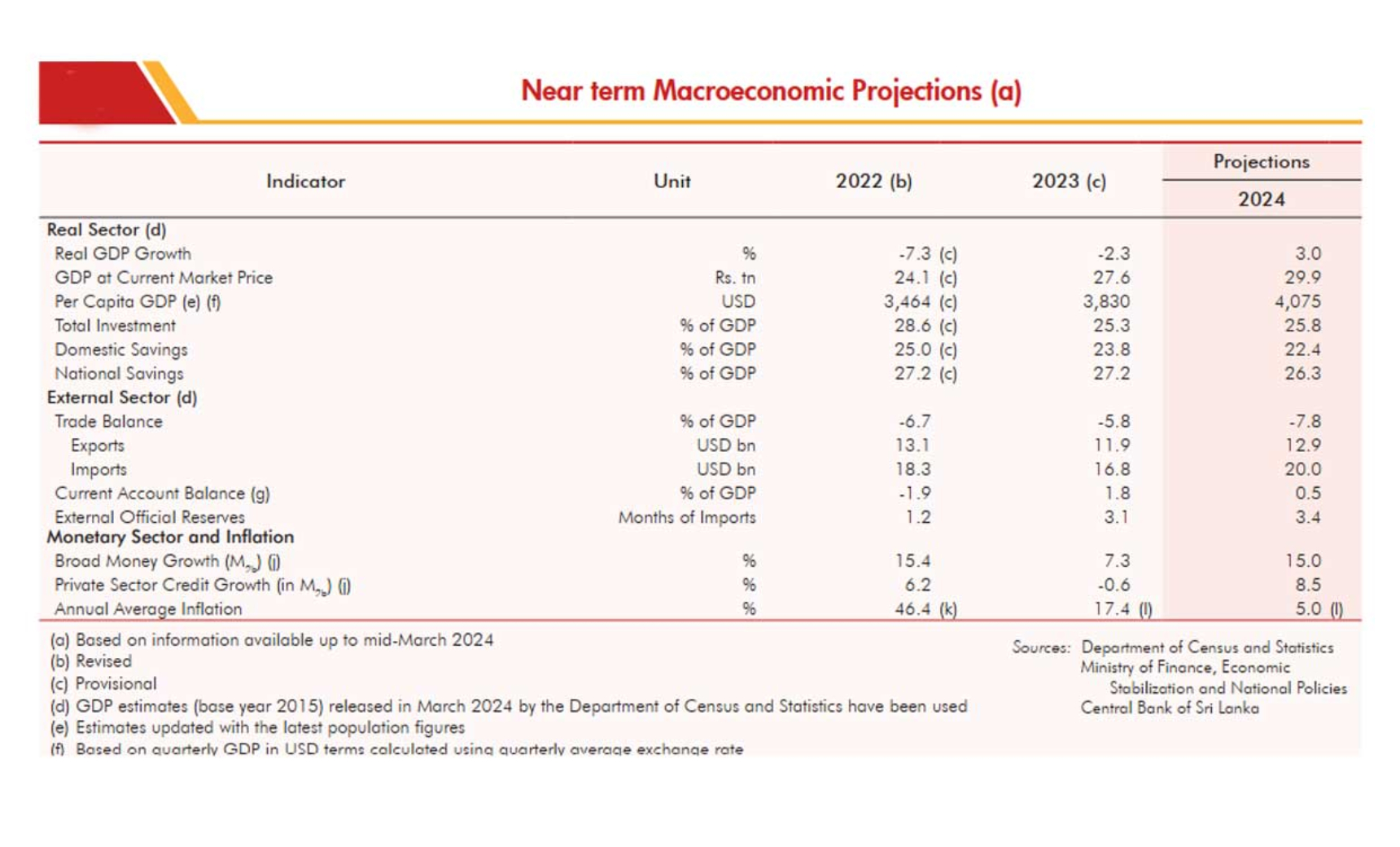

Sri Lanka’s central bank has outlined its economic projections for 2024, anticipating a 3.0 percent growth and a recovery in private credit to 8.5 percent, following a 0.6 percent contraction in 2023. The projections also include an increase in exports to 12.9 billion US dollars from 11.9 billion dollars and a rebound in imports to 20 billion dollars compared to 16.8 billion in the previous year. The country relies on foreign exchange from remittances and tourism to cover imports and service debt, which is contingent on the central bank maintaining stable interest rates and managing liquidity to avoid balance of payments crises.

The central bank’s forecast includes an expectation of 3.4 months of gross official reserves, equivalent to about 5.6 billion dollars, based on import projections. Additionally, a 5 percent of GDP external current account surplus is projected, up from 3.1 percent in 2023, when foreign aid dwindled following a default. The central bank’s approach to monetary policy and reserves management has come under scrutiny, especially concerning its past practices of targeting inflation while accumulating reserves, which critics argue contributed to economic challenges and currency crises in recent years.

Despite recent economic growth and stability in inflation rates, concerns persist about potential instability in monetary policy, particularly if private credit rebounds sharply. Sri Lanka has experienced cycles of recovery and inflationism triggered by shifts in monetary policy, prompting discussions about the effectiveness of current economic doctrines and policy frameworks. The central bank’s strategies, including open market operations and standing facilities, are being closely monitored amid ongoing debates about the country’s economic trajectory and potential risks of inflationary pressures.