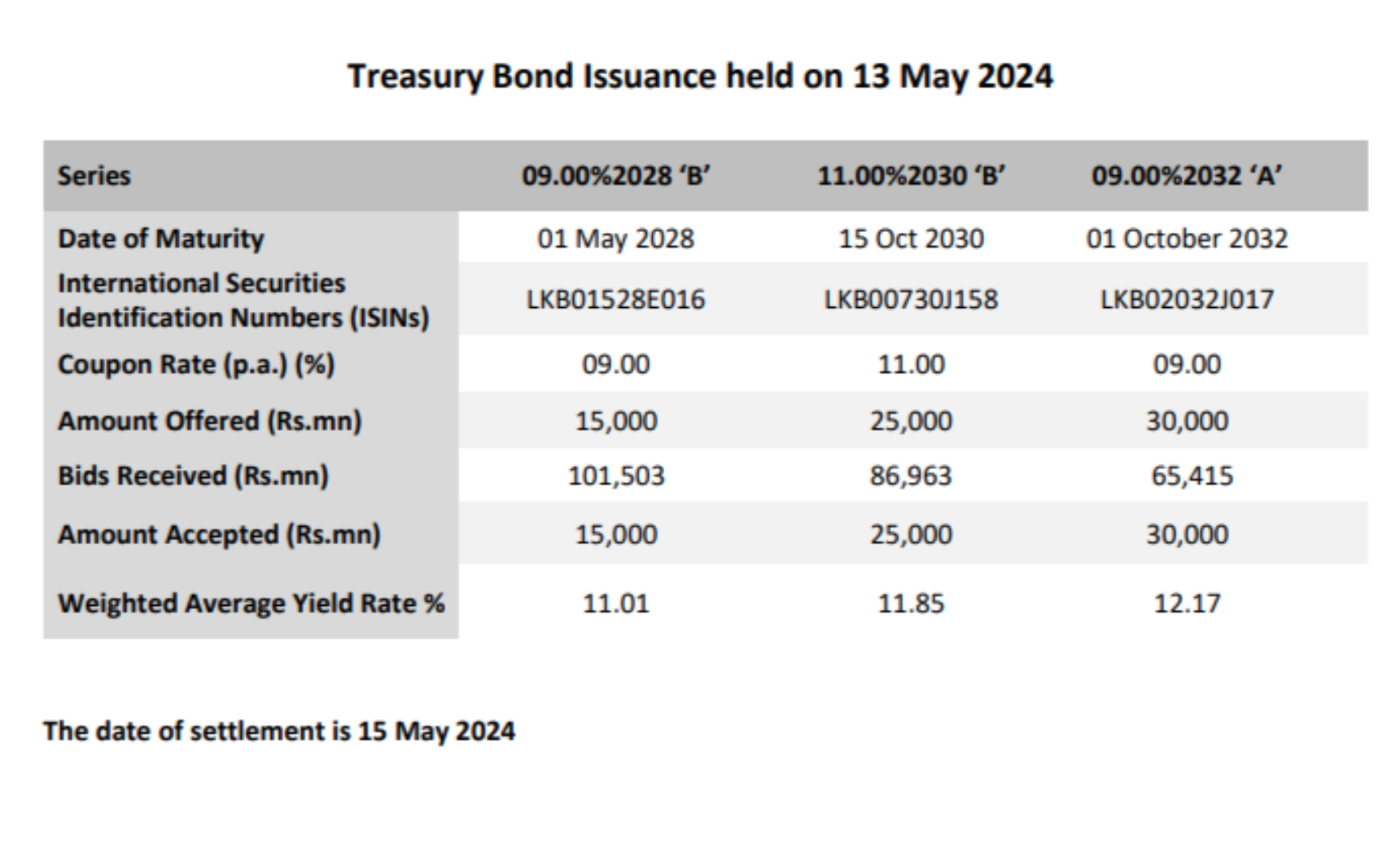

According to data from the state debt office, Sri Lanka has successfully sold 70 billion rupees worth of bonds with maturities in 2028, 2030, and 2032. The debt office managed to sell the entire offered amount of 15 billion rupees of 01 May 2028 bonds at an average yield of 9.00 percent. Additionally, all 25 billion rupees worth of 15 October 2030 bonds were sold at a yield of 11.00 percent. Furthermore, the debt office sold the entire offered amount of 30 billion rupees of 01 October 2032 bonds at a yield of 9.00 percent.

This successful bond sale indicates investor confidence in Sri Lanka’s debt instruments despite recent economic challenges. The government’s ability to raise funds through bond sales is crucial for financing its operations and managing its debt obligations. The sale of these bonds at competitive yields reflects investors’ assessment of the country’s creditworthiness and the perceived risk associated with investing in Sri Lankan debt securities.

The proceeds from these bond sales are expected to be used for various government initiatives and infrastructure projects aimed at promoting economic growth and development. Additionally, the successful sale of bonds with different maturities allows the government to effectively manage its debt profile and spread out its repayment obligations over time. Overall, the bond sale underscores the government’s commitment to maintaining fiscal stability and meeting its financial obligations amidst challenging economic conditions.