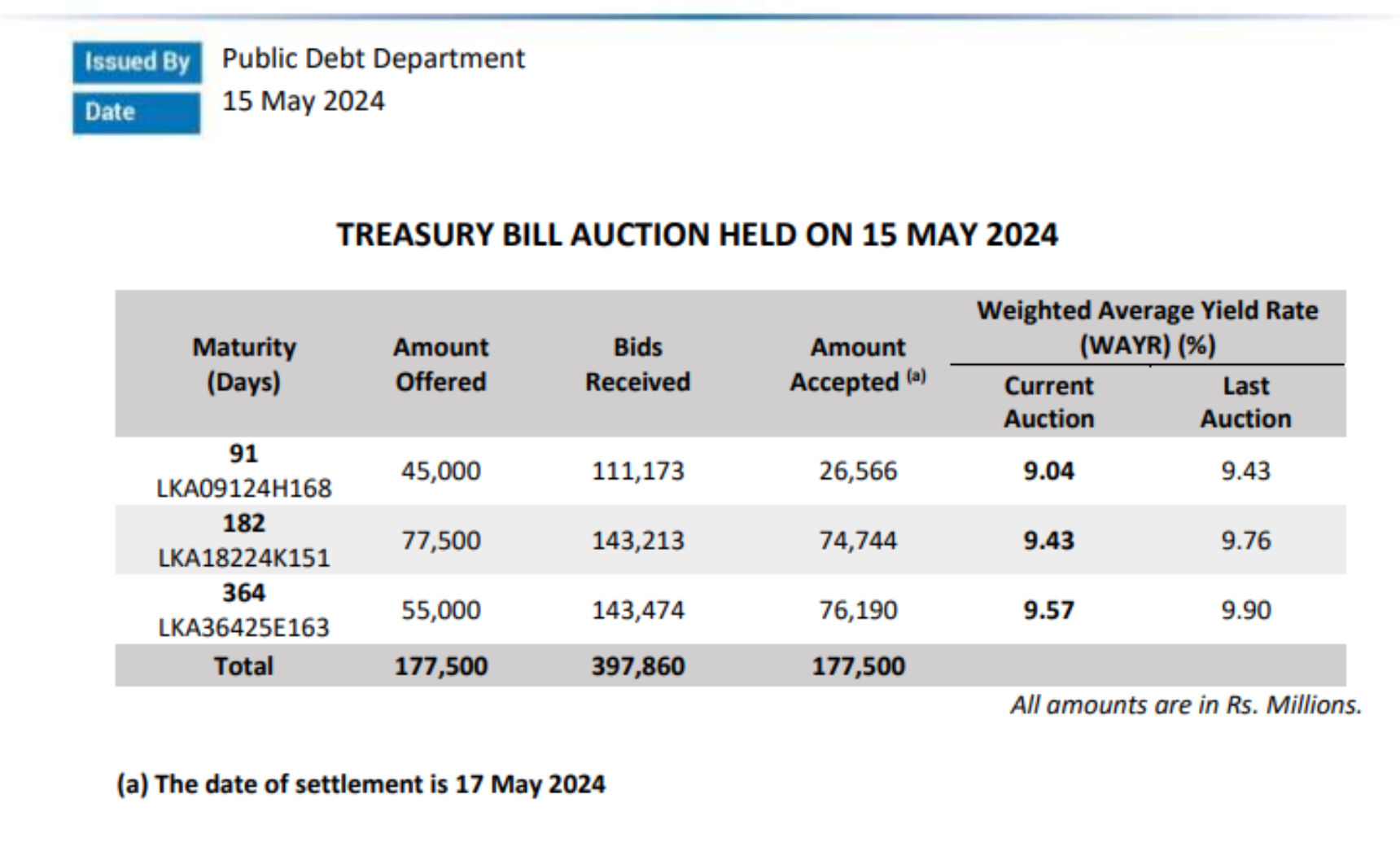

Data from the state debt office revealed a decline in Treasury bill yields across various maturities in Wednesday’s auction. The 3-month yield decreased by 39 basis points, from 9.43 percent to 9.04 percent, with 45 billion rupees in securities offered and 26.56 billion rupees sold.

Similarly, the 6-month yield saw a reduction of 33 basis points, dropping from 9.76 percent to 9.43 percent. The auction featured 77.5 billion rupees in securities offered, of which 74.74 billion rupees were sold.

In the 12-month category, yields also experienced a decrease of 33 basis points, declining from 9.90 percent to 9.57 percent. The auction saw 55 billion rupees in securities offered, with 76.19 billion rupees sold.

These declines in Treasury bill yields indicate a favorable market sentiment and could have implications for borrowing costs and investment strategies in the financial landscape.