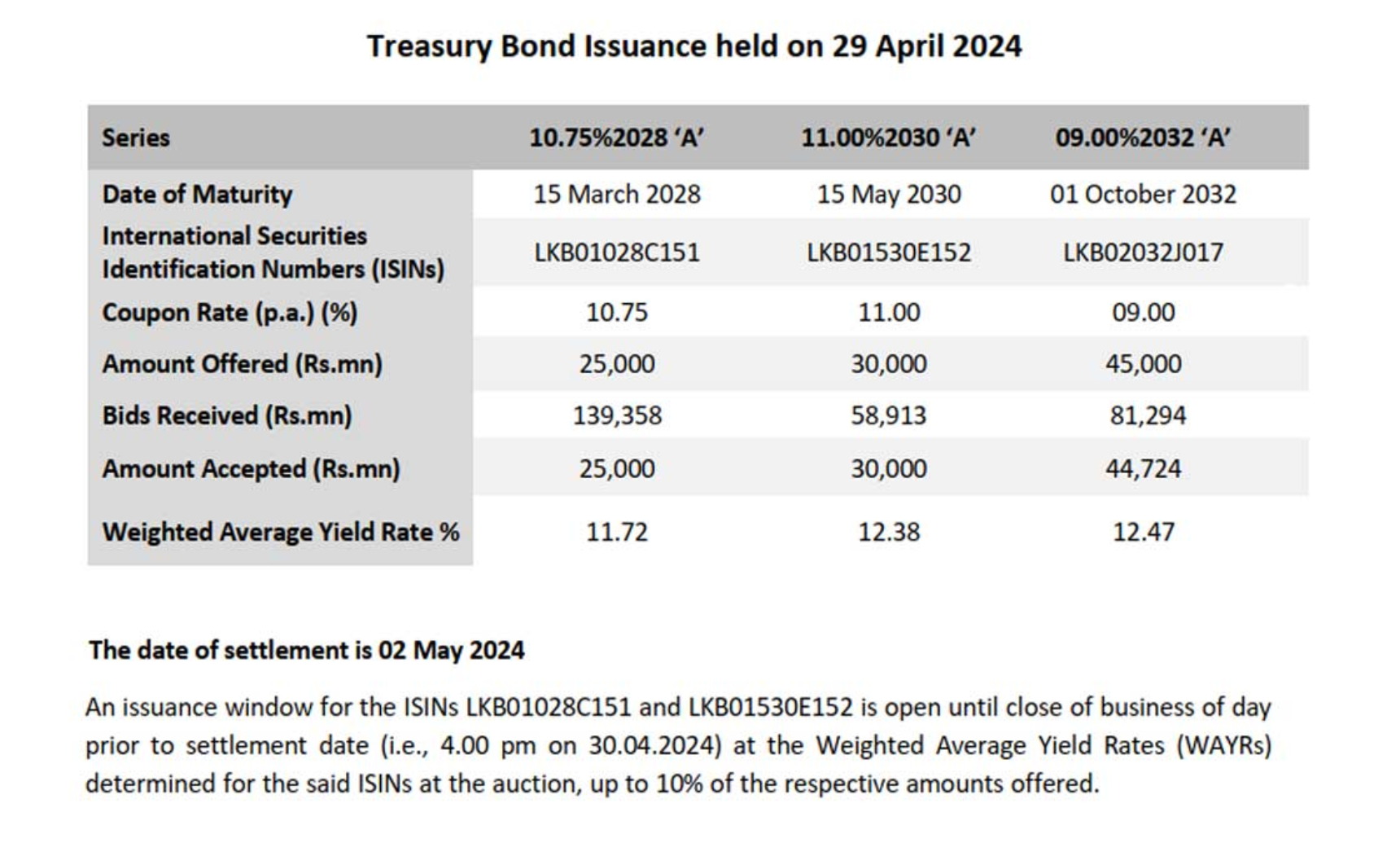

Sri Lanka recently auctioned 99.7 billion rupees worth of bonds maturing in 2028, 2030, and 2032, as reported by the state debt office. The auction saw successful sales across the board, with 15 March 2028 bonds fetching an average yield of 11.72 percent for the offered 25 billion rupees. Additionally, all 30 billion rupees of 15 May 2030 bonds were sold at an average yield of 12.38 percent, while 44.74 billion rupees of 01 October 2032 bonds were snapped up at a yield of 12.47 percent, slightly under the offered 45 billion rupees.

The bond auction’s results indicate investor interest in Sri Lanka’s debt instruments, albeit at relatively high yields. The government’s ability to raise substantial funds through these bond issuances is crucial for managing its financial obligations and maintaining liquidity in the market.