Sri Lanka agreed to a revised deal with the IMF that includes significant tax changes:

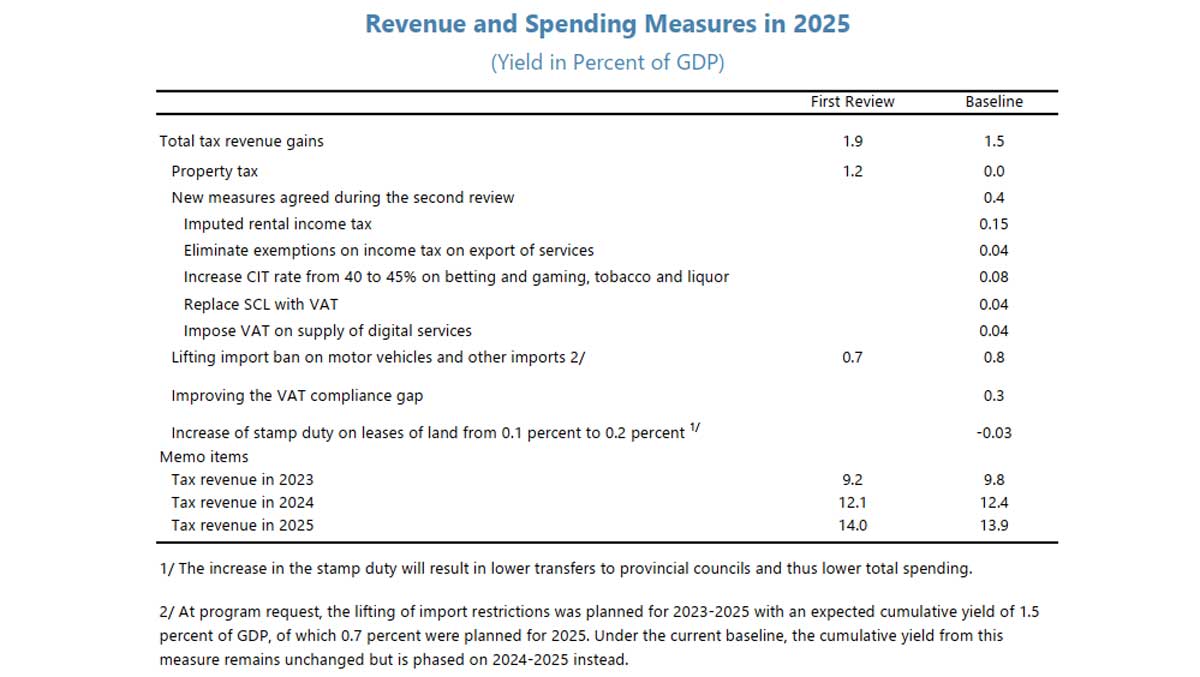

- Tax on owner-occupied houses: This tax will be based on an imputed rent calculation, meaning homeowners will be taxed on the estimated rental income they could earn from their property. The revenue will go to local governments. (Effective April 2025)

- VAT on digital services: Sri Lanka will start charging Value Added Tax on digital services.

- End of services export exemption: Businesses that export services will now be subject to taxes.

- Other tax increases:

- Stamp duty on leases to increase from 0.1% to 0.2%

- Income tax on alcohol, gaming, and tobacco businesses to increase from 40% to 45%

- Special Commodity Levy to be folded into VAT

These changes are expected to be approved by parliament by July 2024 and take effect in January 2025.

Concerns and Context:

- The IMF pushed for these changes, particularly a wealth tax, to improve Sri Lanka’s finances.

- Some worry about taxing owner-occupied houses, especially considering high housing costs and currency depreciation.

- Businesses are concerned about losing the services export exemption, which may lead them to relocate to countries with lower taxes.

- Sri Lanka is attempting to raise revenue without cutting spending, a strategy that has been criticized in the past.

This tax reform is part of Sri Lanka’s effort to address its economic challenges with the help of the IMF.