During Wednesday’s auction, Sri Lanka’s Treasury bill yields experienced a notable decrease across various maturities, with all 135 billion rupees worth of bills being successfully sold, as per data from the state debt office.

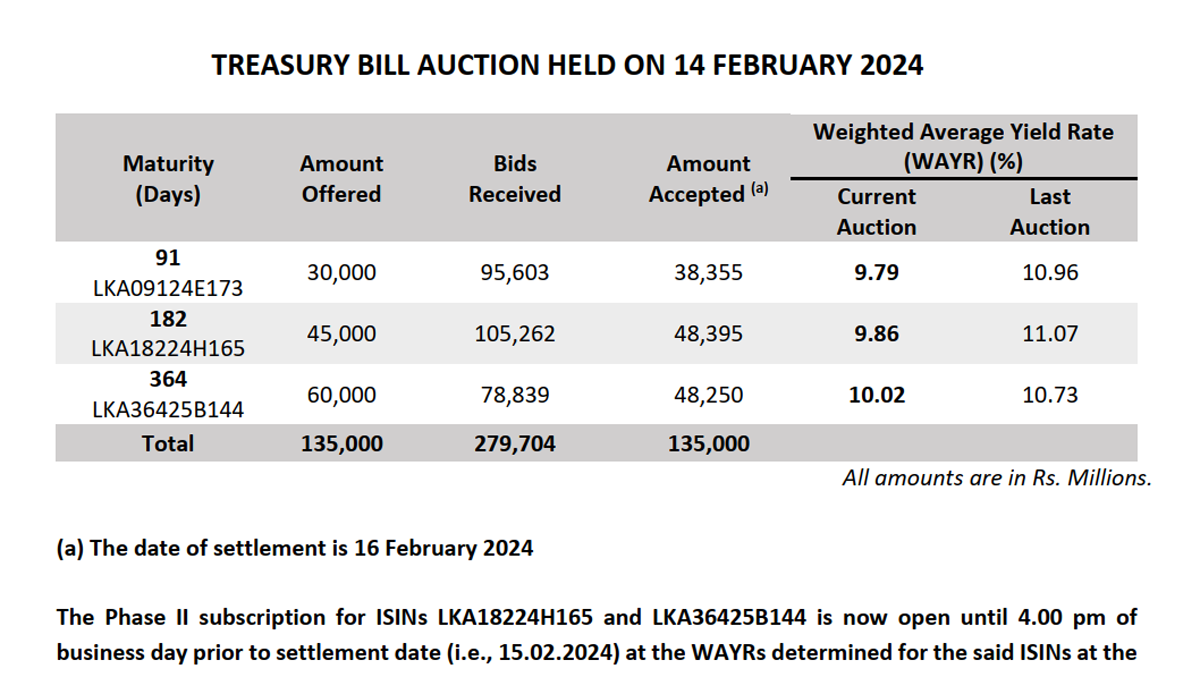

The 3-month yield dropped by 117 basis points to 9.79%, with 30 billion rupees worth of bills offered and 38.35 billion rupees sold. Similarly, the 6-month yield decreased by 121 basis points to 9.86%, with 45 billion rupees offered and 48 billion rupees sold. The 12-month yield also saw a decline, falling by 71 basis points to 10.02%, with 60 billion rupees offered and 48 billion rupees sold.

Recent months have seen Sri Lanka’s central bank actively reducing its Treasury bill stock to bolster forex reserves, while fiscal adjustments have contributed to a moderation in borrowings.

Analysts note that the central bank’s strategy, which involves outright sales of bills at auctions followed by overnight and term reverse repo auctions, has had a broadly deflationary impact on the economy. This has been reflected in the balance of payments, where the outright sales of central bank-held Treasuries have outweighed liquidity operations.

In times of balance of payments surplus and moderate domestic credit, excess liquidity from dollar purchases can lead to a decline in overnight money market rates, potentially approaching zero in the absence of a floor rate.

Analysts emphasize that during recovery periods from currency crises triggered by central bank policy rates, the active policy rate tends to be the lower corridor, provided that central bank-held securities sales do not surpass the dollars purchased in the given period.