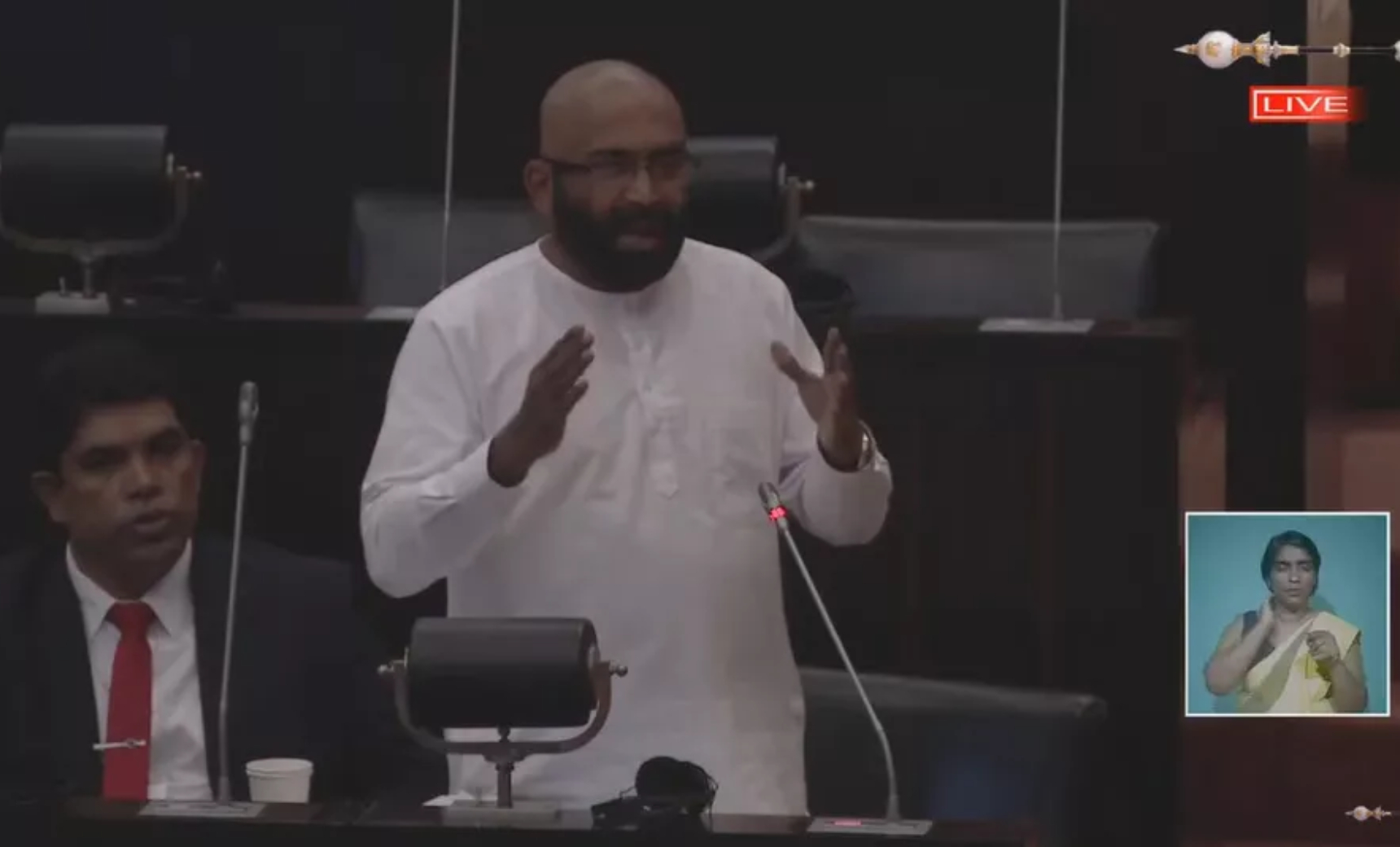

Sri Lanka is contemplating the financial implications of raising the interest rate for senior citizens’ savings to 15%, requiring an estimated Rs 40 billion annually. State Minister of Finance Ranjith Siyambalapitiya highlighted this during a parliamentary session, emphasizing the government’s cautious approach in light of fiscal considerations.

Responding to queries from opposition leader Sajith Premadasa, Siyambalapitiya acknowledged the decline in interest rates for senior citizens, which have dropped to as low as 7-8% in some instances. Premadasa called for government intervention to restore the rate to 15%.

Siyambalapitiya noted that implementing a 15% interest rate would necessitate a substantial annual allocation of around Rs 40 billion, considering past years’ liabilities. He emphasized the government’s meticulous evaluation of the fiscal situation and revenue streams before making any decisions, citing the repercussions of hasty decisions in the past.

Last October, the Inland Revenue Department announced a program to refund advance income tax deducted on interest income for senior citizens. The initiative aimed to support elderly community members by refunding AIT deducted at a 5% rate by banks or financial institutions.

Eligible senior citizens aged 60 or older with an annual income not exceeding Rs 1,200,000 were able to apply for this refund, demonstrating the government’s efforts to alleviate financial burdens for seniors.