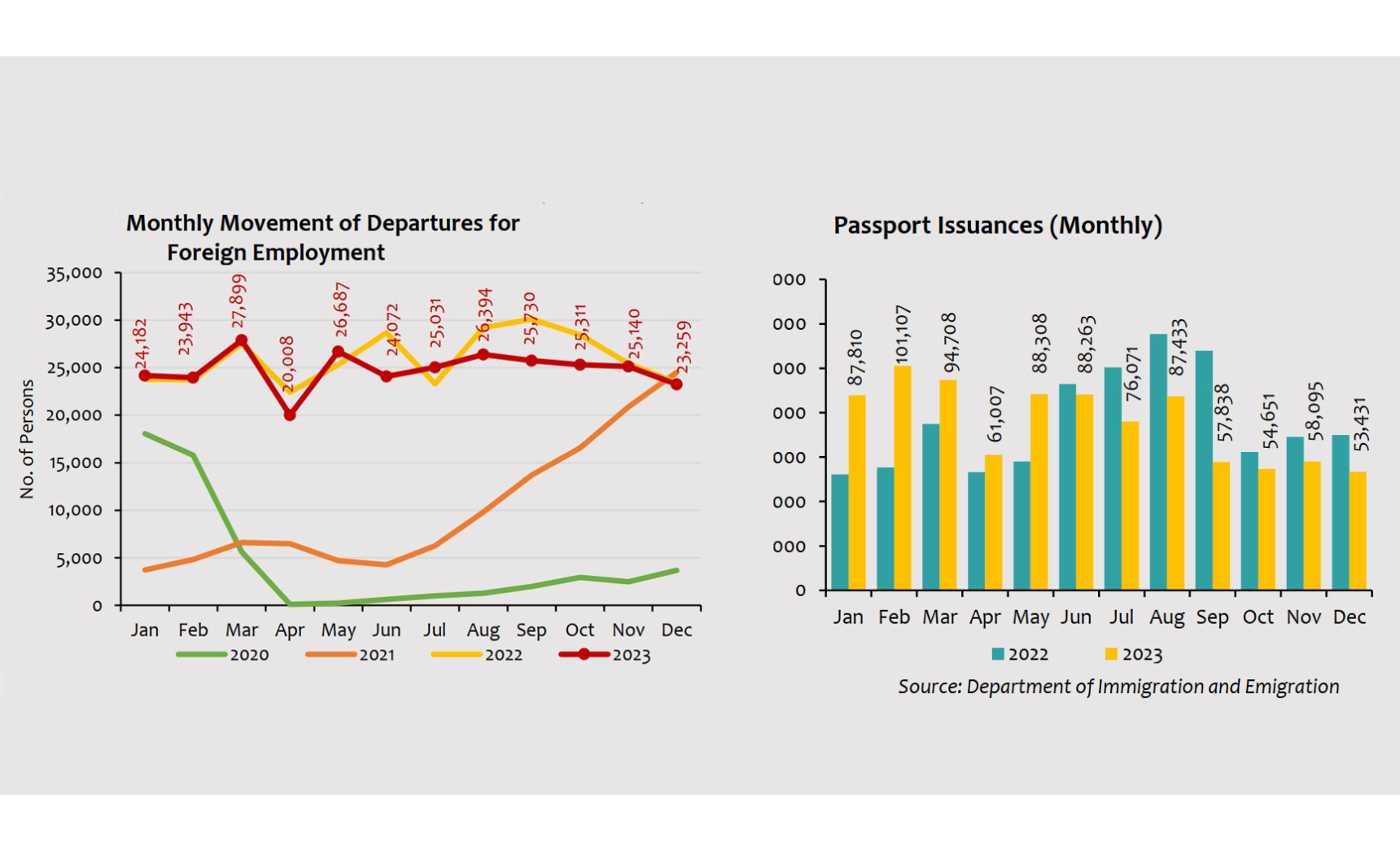

Official data reveals a consistent decline in Sri Lanka’s foreign employment departures over the past five months, accompanied by a decrease in new passport issues for seven consecutive months.

According to the Foreign Employment Bureau data quoted by the central bank, departures for foreign employment have steadily decreased from 26,394 in August 2022 to 23,259 in December 2023. Similarly, new passport issues witnessed a decline, with numbers dropping from 115,403 in August 2022 to 53,431 in December 2023.

The trend of declining departures began in June 2023, with a noticeable reduction in passport issues from that month onwards. In 2022, June recorded 92,880 passport issues, whereas in 2023, the number fell to 88,308. This downward trajectory continued, with July 2023 seeing 76,071 passport issues compared to 100,396 in July 2022.

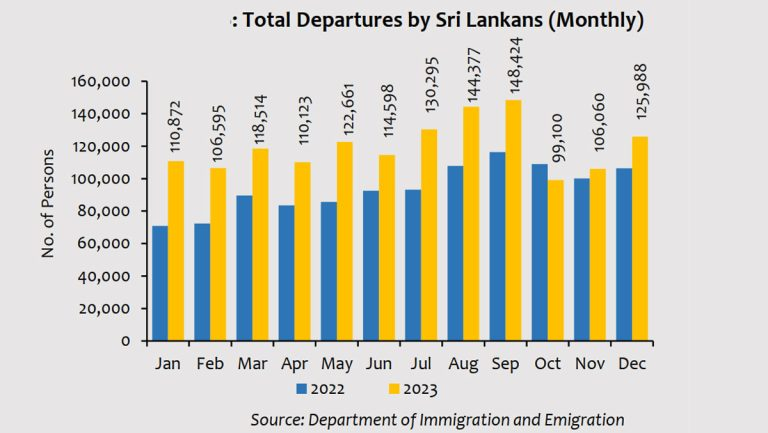

Despite these declines, total departures of Sri Lankans from the country for various purposes have shown an overall increase. This could be attributed to improving incomes leading to a rise in outbound tourism activities. Advertisements for outbound travel, including pilgrimages to India (Dambadiva charika), have been observed in Sri Lankan media amid stable monetary conditions.

The government has taken measures to control workers departing on tourist visas and address potential misdeclarations during departures. The country witnessed a surge in outmigration following a period of monetary expansion aimed at stimulating economic growth. However, this practice contributed to currency depreciation and inflationary pressures.

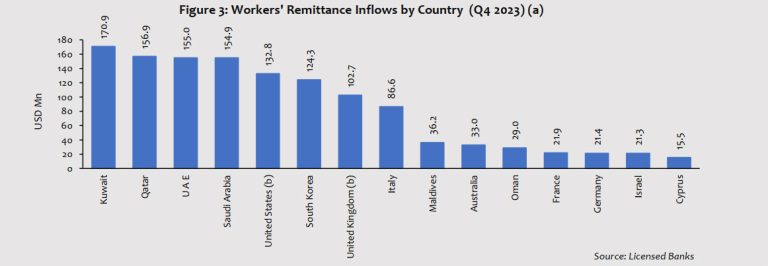

Most outbound workers migrate to countries in the Middle East with stable monetary regimes, such as Kuwait, Qatar, UAE, and Saudi Arabia, which are major sources of remittances for Sri Lanka. The recent stability in the Sri Lankan rupee has led to lower prices, increased real wages, and salary raises by firms.

Critics argue that Sri Lanka’s macroeconomic policies, characterized by inconsistent narratives and reliance on inflationary measures, have hindered the establishment of a sound monetary framework. The current operational framework, where interest rates are manipulated based on inflation levels, has raised concerns about potential currency vulnerabilities in the future.