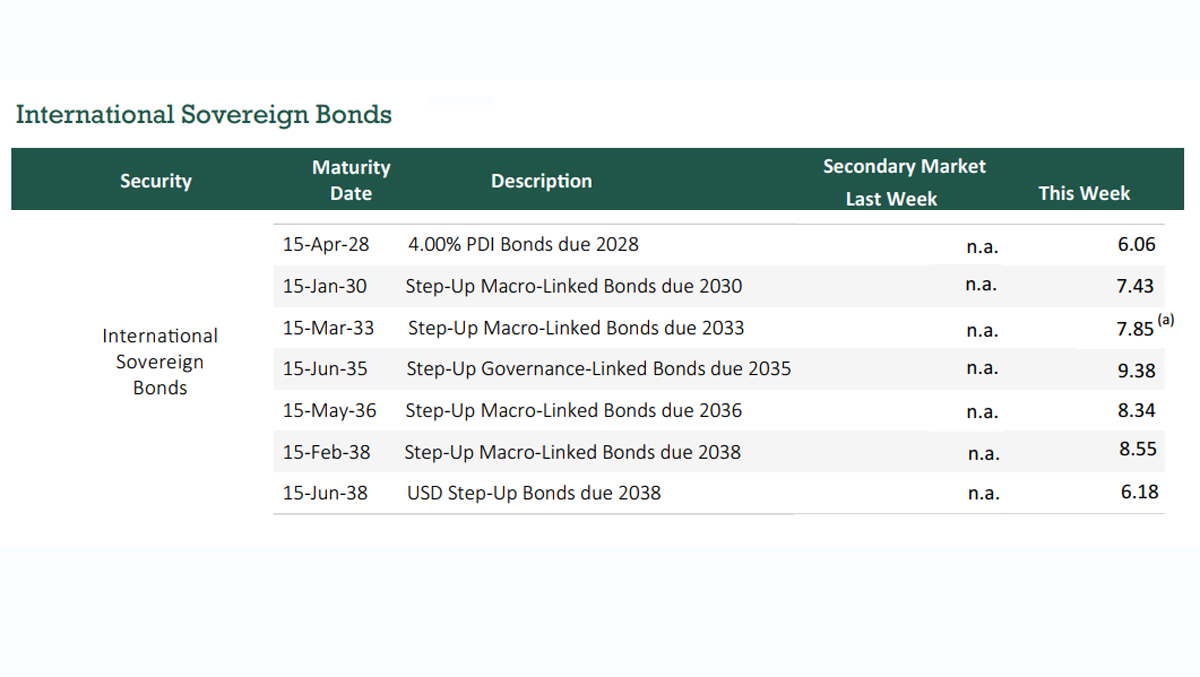

A plain sovereign bond with a 4.0% coupon maturing in 2028 was quoted at around 6.0% in its first week of trading, according to data from Sri Lanka’s central bank. The 6.0% rate represents a 200-basis point risk premium compared to 3 and 5-year bonds with yields of 4.0% to 4.1%, despite Sri Lanka’s CCC+ credit rating.

At these levels, analysts suggest Sri Lanka could potentially roll over its debt. The country issued several bonds with lower coupons than US Treasuries, some with macro-linked features where the principal adjusts based on GDP growth, complicating their pricing. Macro-linked bonds maturing in 2030, 2033, 2035, and 2038 were quoted at 7.43%, 7.85%, 8.34%, and 8.55%, respectively.

A governance-linked bond, which offers a coupon reduction of up to 75 basis points if specific fiscal and policy targets are achieved, had the highest yield at 9.38% in its initial week of trading.