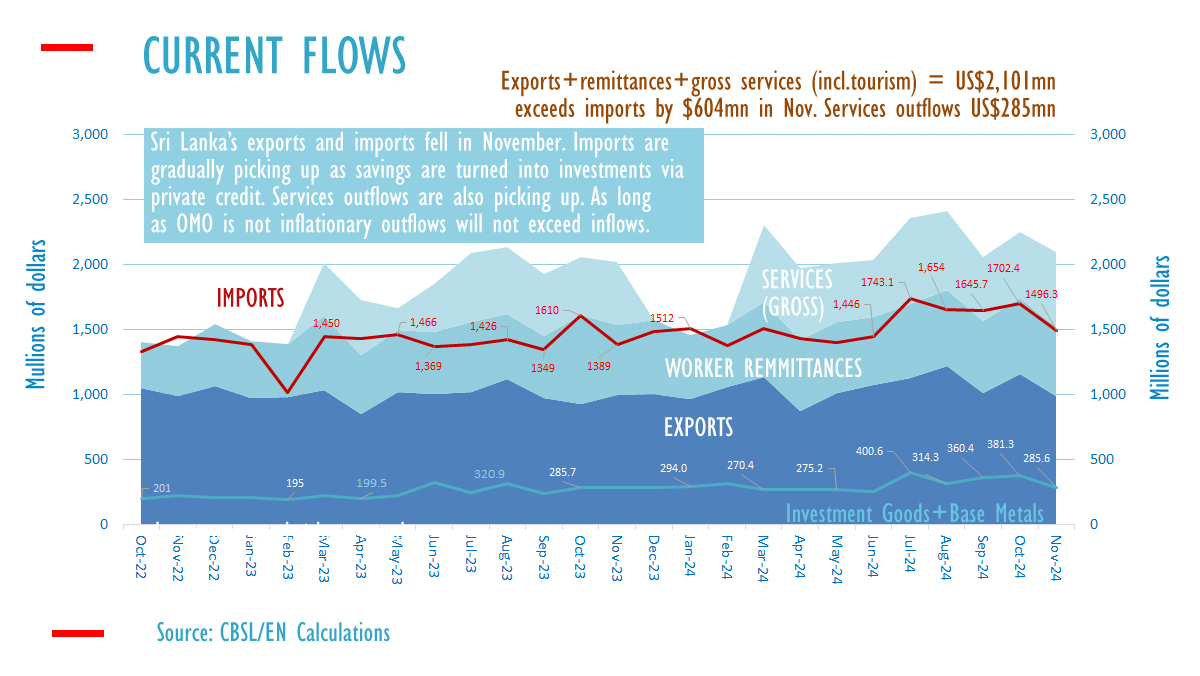

Sri Lanka’s foreign exchange inflows in November 2024 amounted to 2.1 billion US dollars, surpassing imports by 604 million US dollars, according to data released by the central bank.

The current inflows were composed of 994.1 million US dollars in exports, 576 million dollars in services (including an estimated 272 million dollars from tourism), and official worker remittances of 530 million US dollars.

As most private citizens are net savers, foreign exchange inflows typically turn into outflows as the banking system extends credit for investments. For the money to be spent, it must first be earned or come from foreign loans, meaning inflows and outflows will match unless the central bank prints money to cut interest rates.

Investment goods and base metals have seen a gradual recovery over 2023 and 2024 after significant declines due to private credit contraction. Services outflows have also started to rise, reaching 285.3 million US dollars in November (up from 193.3 million US dollars last year), with travel abroad accounting for 68.9 million dollars.

The Sri Lanka central bank has maintained a broadly deflationary policy since late 2022, allowing it to build reserves through a balance of payments surplus generated by curtailed credit. However, there are concerns that inflationary pressures are beginning to build up. Weak credit conditions and injected liquidity (along with liquidity from dollar purchases via the peg) have contributed to this situation.

Analysts warn that if money is injected through open market operations to maintain interest rates that are incompatible with the balance of payments, the country could face a second default and potential social unrest from currency depreciation in the New Year.

Sri Lanka’s exchange controls, combined with rising import restrictions and inflationary open or direct market operations, indicate a flawed operating framework with conflicting economic objectives.