According to the Institute of Policy Studies (IPS), Sri Lanka’s export economy remains heavily reliant on apparel, with goods and services exports accounting for approximately 20.4% of GDP in 2023. Of this, manufacturing exports contributed 14%, and a staggering 77% of export income is derived from industrial goods, primarily apparel. In contrast, agricultural exports account for just 22%, leaving the economy vulnerable to fluctuations in the apparel and traditional agricultural sectors like tea and rubber.

At a recent event launching the “State of the Economy 2024” report, IPS highlighted that the concentration of exports raises critical questions about whether reforms in trade, energy, and agriculture can drive recovery. Research Fellow Asanka Wijesinghe discussed the potential advantages of Sri Lanka joining the Regional Comprehensive Economic Partnership (RCEP), suggesting it could facilitate a shift toward more complex products, such as electronics.

While acknowledging short-term concerns regarding trade deficits with RCEP countries, Wijesinghe emphasized the long-term benefits, including increased exports and participation in regional manufacturing value chains. For instance, a trade partnership with China could increase Sri Lankan exports to China by 42%, while a free trade agreement with Indonesia could boost exports by 85% through the full liberalization of 155 identified products.

The need for a revised incentive structure for domestic production was also discussed, as it could reallocate resources towards export-oriented goods. However, the potential impact on the domestic labor market cannot be ignored, as certain sectors may face competition from imports.

The discussion further addressed energy pricing and its implications for export competitiveness. IPS Research Fellow Erandathie Pathiraja noted that rising energy costs, particularly electricity tariffs, are affecting the apparel and tea sectors. The share of electricity costs in the apparel sector has increased from 3.38% in 2019 to 5.58% in 2023, resulting in higher overall production costs and shrinking profit margins.

To adapt to these challenges, IPS recommends implementing assistance schemes to help industries transition to new energy policies. Suggestions include providing technical and financial support for renewable energy installations and temporary tax relief for vulnerable sectors.

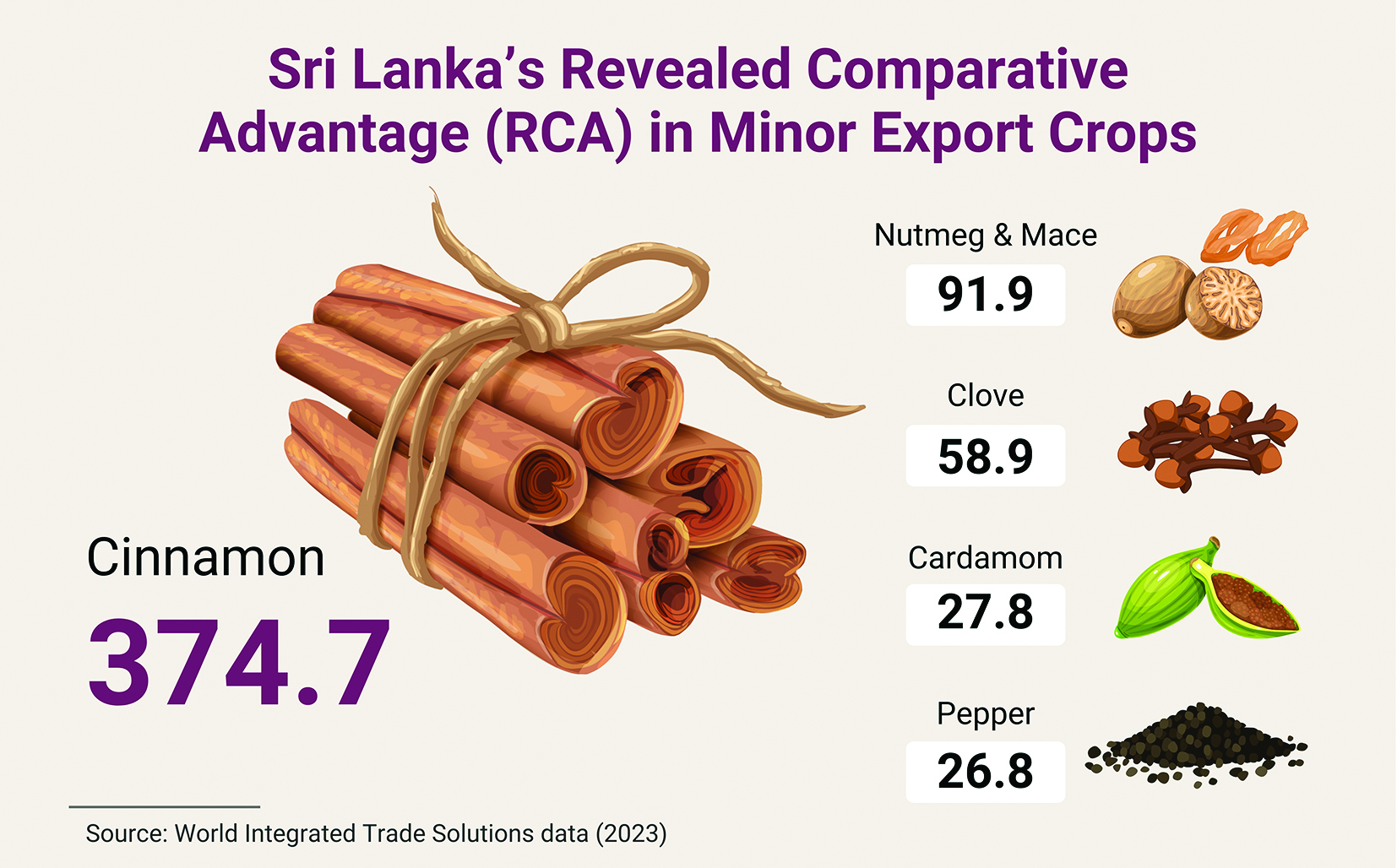

Additionally, the IPS called for investment and policy support to unlock the potential of Sri Lanka’s minor export crops, which have gained global recognition for their unique quality. Research Economist Dilani Hirimuthugodage emphasized the importance of diversifying beyond traditional export crops and enhancing farm productivity through improved practices and certification systems.

Hirimuthugodage also highlighted the significant untapped potential of crops like Ceylon cinnamon and black tea in key markets such as the United States, India, and Vietnam. Strengthening regulatory measures is deemed crucial for ensuring economic stability, as poorly implemented policies have historically disrupted critical sectors.

IPS concluded that focusing on sound regulations in energy pricing, trade liberalization, and export diversification is essential for enhancing Sri Lanka’s global competitiveness and achieving long-term economic resilience.