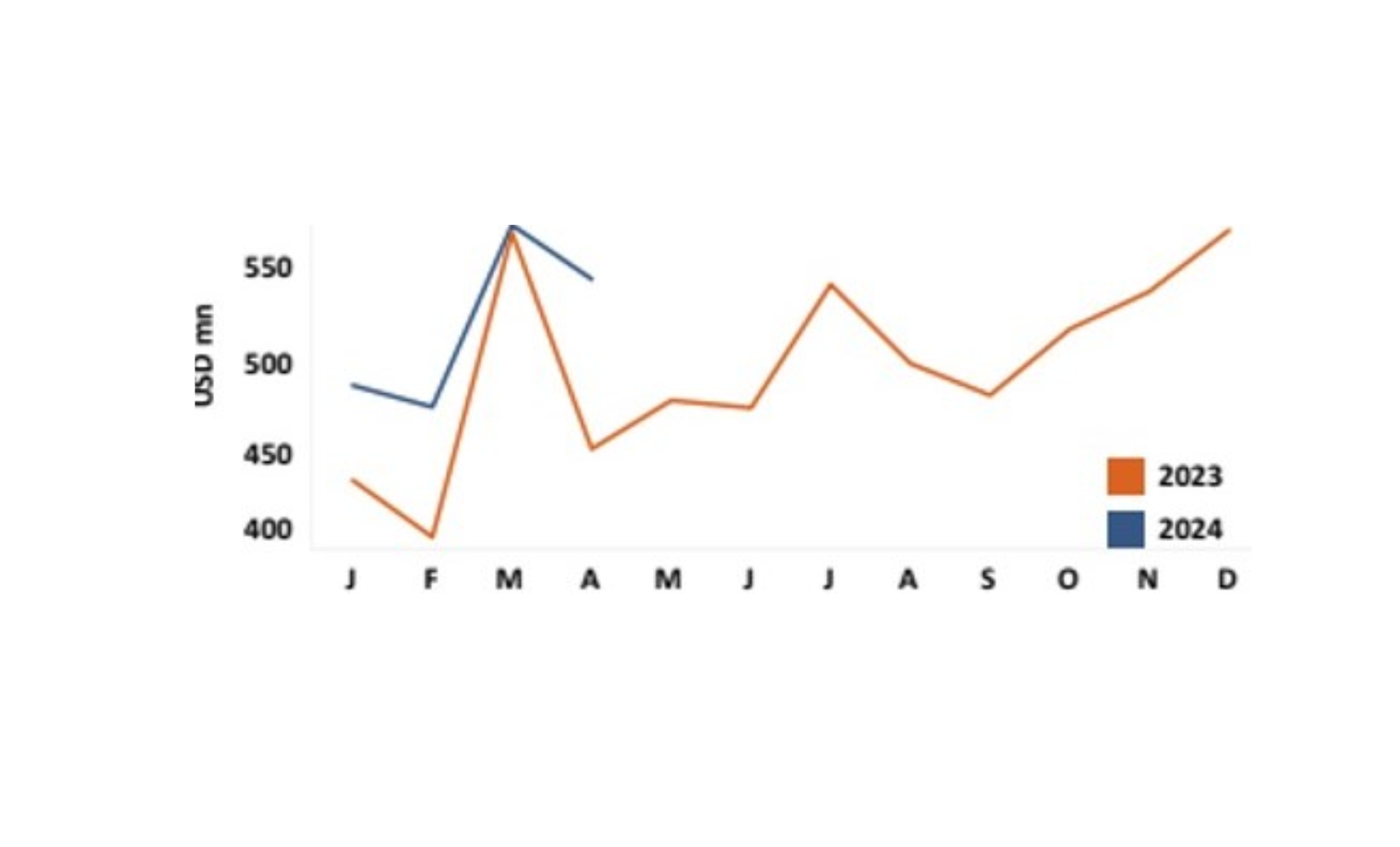

Sri Lanka’s remittances through official channels have exceeded 2 billion dollars in the first four months of this year, marking a notable increase. This surge is attributed to more expatriates utilizing official banking channels, following the central bank’s abandonment of a parallel exchange rate regime. Official data reveals that remittances during this period amounted to 2,079.9 million dollars, representing an 11.4 percent rise compared to the same period last year.

In the first four months of 2023, Sri Lanka recorded remittances worth 1,867.2 million dollars, showcasing a substantial growth trend. Specifically in April, the country received 543.8 million dollars through official channels, indicating a 19.7 percent increase from the previous year’s figure of 454 million dollars. These statistics highlight a positive trajectory in Sri Lanka’s external sector, signaling recovery and stability.

The improvement in remittances follows strategic measures by the central bank, including the cessation of money printing to sterilize interventions made with Indian Asian Clearing Union funds. This shift has resulted in balance of payments surpluses and a more sustainable economic environment. Notably, the recent increase in official exchange rates has curbed parallel exchange rate activities, contributing to enhanced credit conditions and reduced pressure on money printing to maintain policy rates.

The trajectory of remittances through official channels reflects a positive turn in Sri Lanka’s economic landscape, emphasizing the efficacy of recent policy adjustments. This resurgence in remittances, coupled with prudent monetary measures, sets a promising course for sustained economic growth and stability in the country.