Sri Lanka’s national carrier, SriLankan Airlines, has reported a turnaround in its financial performance, swinging from a massive loss in 2023 to a net profit in the first nine months of 2024. This positive shift is largely attributed to the stabilization of the Sri Lankan rupee after a period of depreciation.

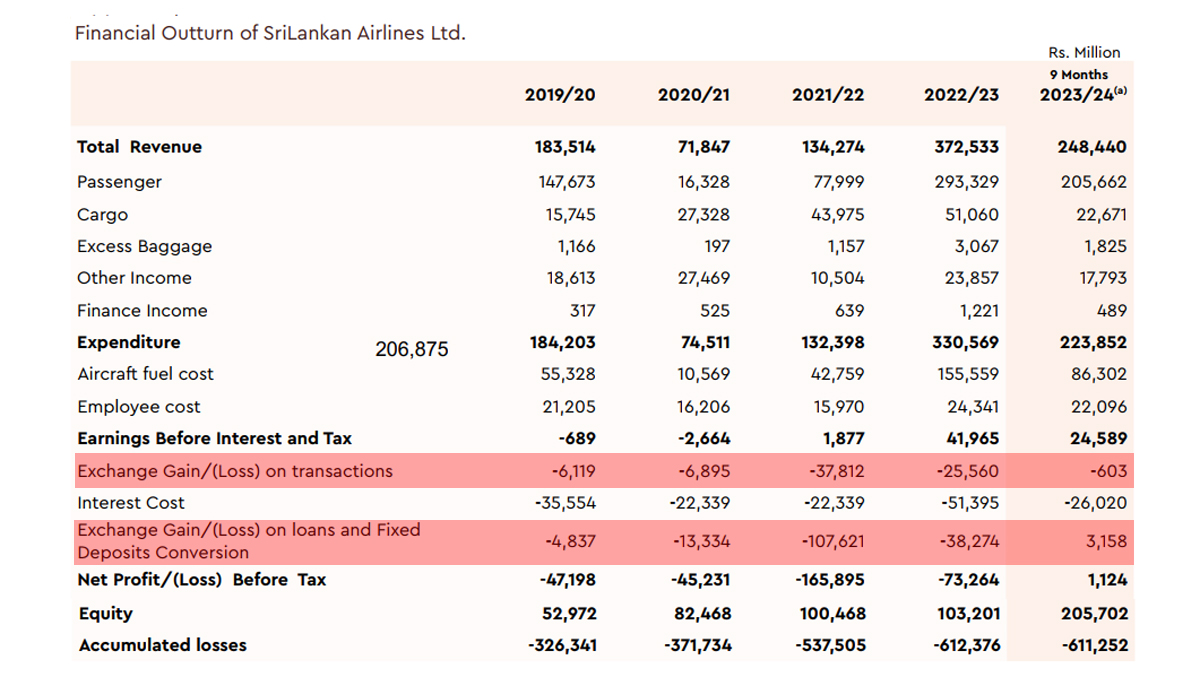

The airline recorded a net profit of 1.124 billion rupees for the period ending December 2023, a stark contrast to the 73.26 billion rupee loss it suffered in the previous financial year. This turnaround comes despite a slight dip in earnings before interest and tax compared to the same period in 2022.

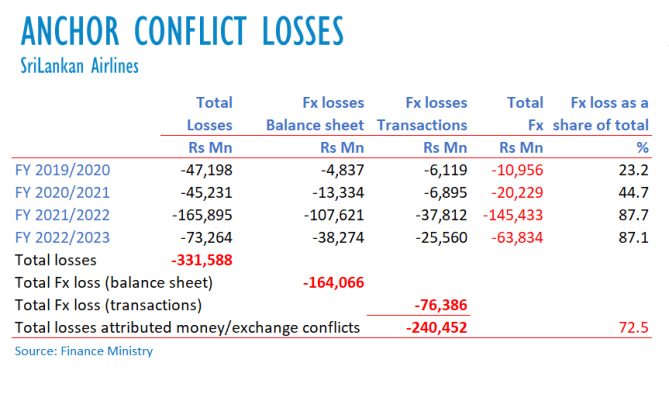

The financial results highlight the significant impact of currency fluctuations on SriLankan Airlines. In the past four years, the company grappled with a staggering 240 billion rupees in losses solely due to exchange rate depreciation. However, with the recent stability of the rupee, these losses have been significantly reduced.

SriLankan Airlines also managed to cut down on interest costs compared to the previous year, contributing to the improved financial standing. The government’s financial support, including a capital injection of 102.5 billion rupees, also played a role in the airline’s recovery.

While the outlook appears positive, some uncertainties remain. The report identifies a continuing loss on “transaction-related” currency exchange, though the exact cause is unclear. This suggests that SriLankan Airlines might still be vulnerable to currency fluctuations depending on how it settles its dollar-denominated payments with suppliers.

Overall, SriLankan Airlines’ return to profitability marks a significant step forward for the national carrier. The stabilizing rupee appears to be a key factor in this positive development. However, the airline’s financial health will likely remain closely tied to the future stability of the Sri Lankan currency.