The newly implemented additional tariffs on US imports from Canada, China, and Mexico, which took effect on March 4, have escalated trade tensions, increasing the likelihood of a trade war between the United States and its major trading partners. Additionally, the US Presidential Memorandum on Reciprocal Trade and Tariff has mandated studies on ‘unfair trade practices’ by its trade partners to determine reciprocal tariff rates. Under this system, if a country imposes a 10% tariff on US imports, the US will reciprocate with the same rate, mirroring its partner’s tariff structure.

With the US managing approximately 13,000 tariff lines, 200 trading partners, and 2.6 million individual tariff rates, the full implementation of reciprocal tariffs could have significant global economic consequences, potentially leading to retaliatory measures from affected countries.

Potential Impact on Sri Lanka’s Exports

A trade war between the US and the EU could negatively impact countries like Sri Lanka by reducing EU import demand, making sustainable export growth more challenging. Additionally, tariff threats are being used as bargaining tools, with the US potentially withdrawing high tariffs in exchange for concessions from major partners.

For Sri Lanka, a small economy reliant on external value chains, the disintegration of the global free trade system could have severe consequences. The US is a key export destination, accounting for nearly 25% of Sri Lanka’s total exports. If the proposed tariffs take effect, they may impact Sri Lankan exports significantly.

How the US Determines Reciprocal Tariff Rates

The US Trade Representative (USTR) defines ‘unfair trade practices’ broadly, providing flexibility in determining reciprocal tariff rates. These include high tariffs, non-tariff barriers, subsidies, regulatory burdens, exchange rate interventions, and even VAT. With over 170 economies implementing VAT as a key revenue source, the inclusion of VAT in the reciprocal tariff calculation creates further uncertainty. The US aims to complete its studies on these practices by April 1, 2025.

Reciprocal Tariffs and Sri Lanka’s Trade Sectors

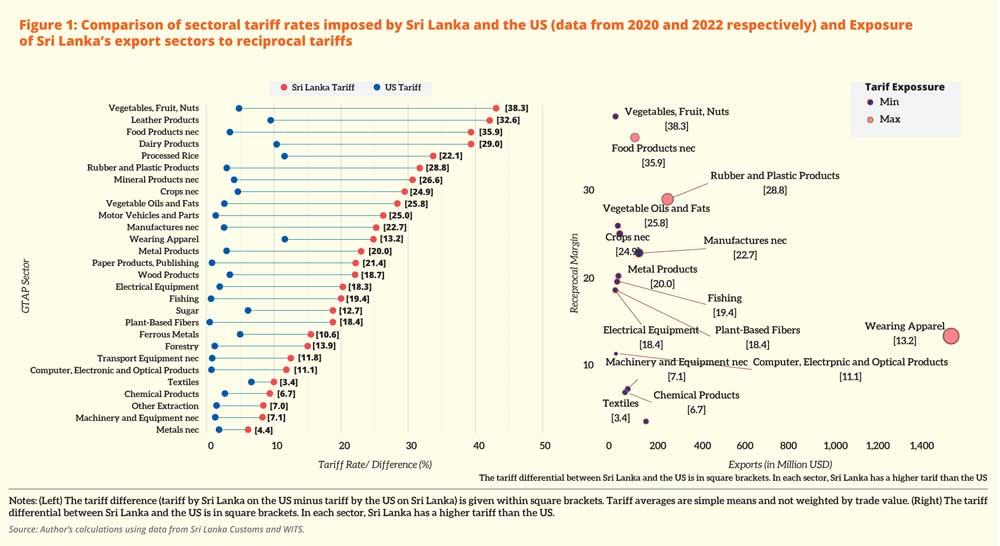

Sri Lanka’s tariff structure includes general customs duties, Export Development Board cess, excise duty, port and airport levies, and social security contribution levies. On an ad valorem basis, Sri Lanka’s tariff rates are generally higher than those of the US. If the US imposes reciprocal tariffs, Sri Lankan exports could face higher costs in the US market, particularly affecting industries such as apparel, rubber, plastic products, and food exports.

The magnitude of the impact depends on the tariff differential—industries where Sri Lanka imposes significantly higher tariffs than the US will be the most vulnerable. The impact can be estimated once the US announces its reciprocal tariff rates. However, a uniform application of tariffs is unlikely due to potential inflationary consequences.

If key competitors such as China and Mexico face higher relative tariff hikes, Sri Lanka might experience some benefits from trade diversion. Apparel exporters to the US, including China and Mexico, are expected to be directly targeted by these tariff increases. For instance, Mexico currently enjoys zero apparel tariffs under the United States-Mexico-Canada trade agreement.

Despite potential trade diversion benefits, broader economic impacts could reduce US import demand. The new tariffs on Canada, China, and Mexico are expected to cost an average US household approximately $1,200 annually. Combined with potential retaliatory tariffs and supply chain disruptions, this could lower overall demand for imports, dampening any positive gains Sri Lanka might anticipate. Additionally, an EU-US trade conflict could further slow the EU economy, reducing its import demand, including from Sri Lanka.

Sri Lanka’s Response: Phasing Out Para-Tariffs and Strengthening Trade Relations

Sri Lanka heavily relies on para-tariffs and special commodity levies (SCL). Efforts are underway to phase out these levies and replace them with VAT. Under the Singapore-Sri Lanka Free Trade Agreement, some cess and port and airport levies have already been eliminated. Similarly, the Sri Lanka-Thailand Free Trade Agreement aims to phase out para-tariffs. Expanding these measures to all trade partners could help narrow the tariff differential with the US, reducing Sri Lanka’s exposure to reciprocal tariff hikes.

A more pressing concern for Sri Lanka is the increasing shift toward protectionist trade policies. As global free trade structures weaken, Sri Lanka’s economic growth could be severely impacted. To mitigate these risks, Sri Lanka must strengthen its trade relations with regional partners, particularly growing middle-income economies in East Asia.

Negotiating free trade agreements (FTAs) with East Asian countries and enhancing the Indo-Sri Lanka FTA are strategic moves Sri Lanka should pursue. Addressing barriers such as apparel quotas in the Indian market could help Sri Lanka leverage India’s growing middle-class consumer demand. As global trade dynamics shift, Sri Lanka must take proactive measures to secure its position in a more protectionist world economy.