Sri Lanka is gearing up to resume discussions with bondholders, expressing optimism about reaching a resolution regarding debt restructuring by June 2024. These negotiations have primarily centered around the bondholders’ proposal, particularly the introduction of a Macro-Linked Bond (MLB). First Capital Research’s monthly economic watch for May 2024 highlighted the evolving nature of these discussions, noting a 20% haircut initially proposed in March on existing bonds, which was revised to 28% in April, with no cuts on Public Debt Interests (PDIs) in both proposals.

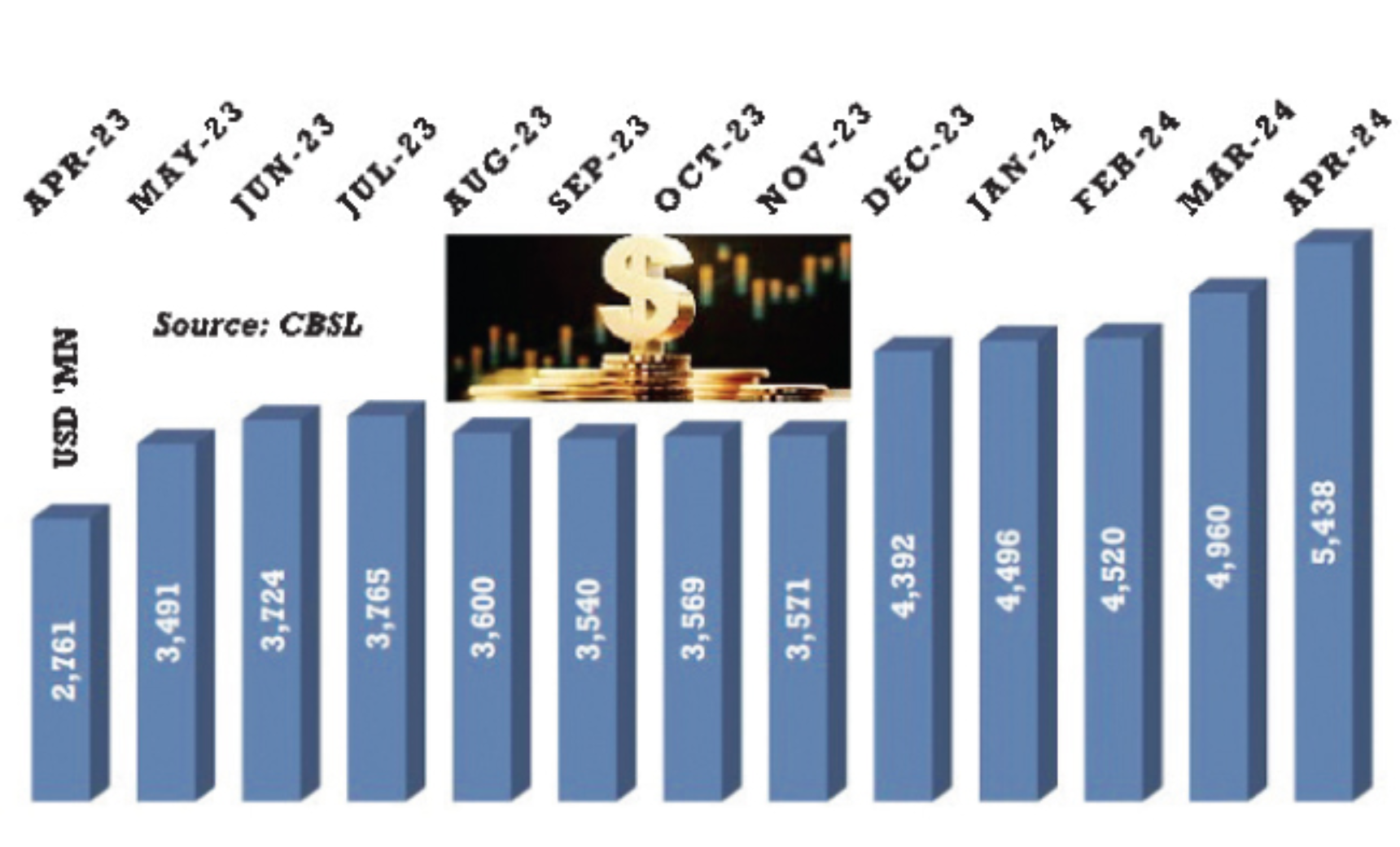

Recent developments indicate progress as bondholders revised their proposal in April 2024 to address some of the government’s concerns, with the International Monetary Fund (IMF) currently assessing the latest proposal from the ad hoc group. Meanwhile, Sri Lanka’s economic landscape has seen positive shifts, with Foreign Reserves increasing by USD 478.0 million in April 2024 to reach USD 5.4 billion, attributed to continuous dollar buying by the Government.

Market Liquidity showed fluctuations but trended positively in April 2024. Noteworthy economic achievements include a 9.8% year-on-year increase in export earnings on March 24, totaling USD 1,138.9 million, with all major export categories, including industrial, agricultural, and mineral goods, seeing boosts. March also saw a significant rise in textile and garment exports, marking the highest levels recorded since December 2022. Additionally, Workers’ Remittances and Tourism earnings showed marginal increases, contributing to a favorable Balance of Payment for March 2024, recording a net inflow of USD 472.8 million.