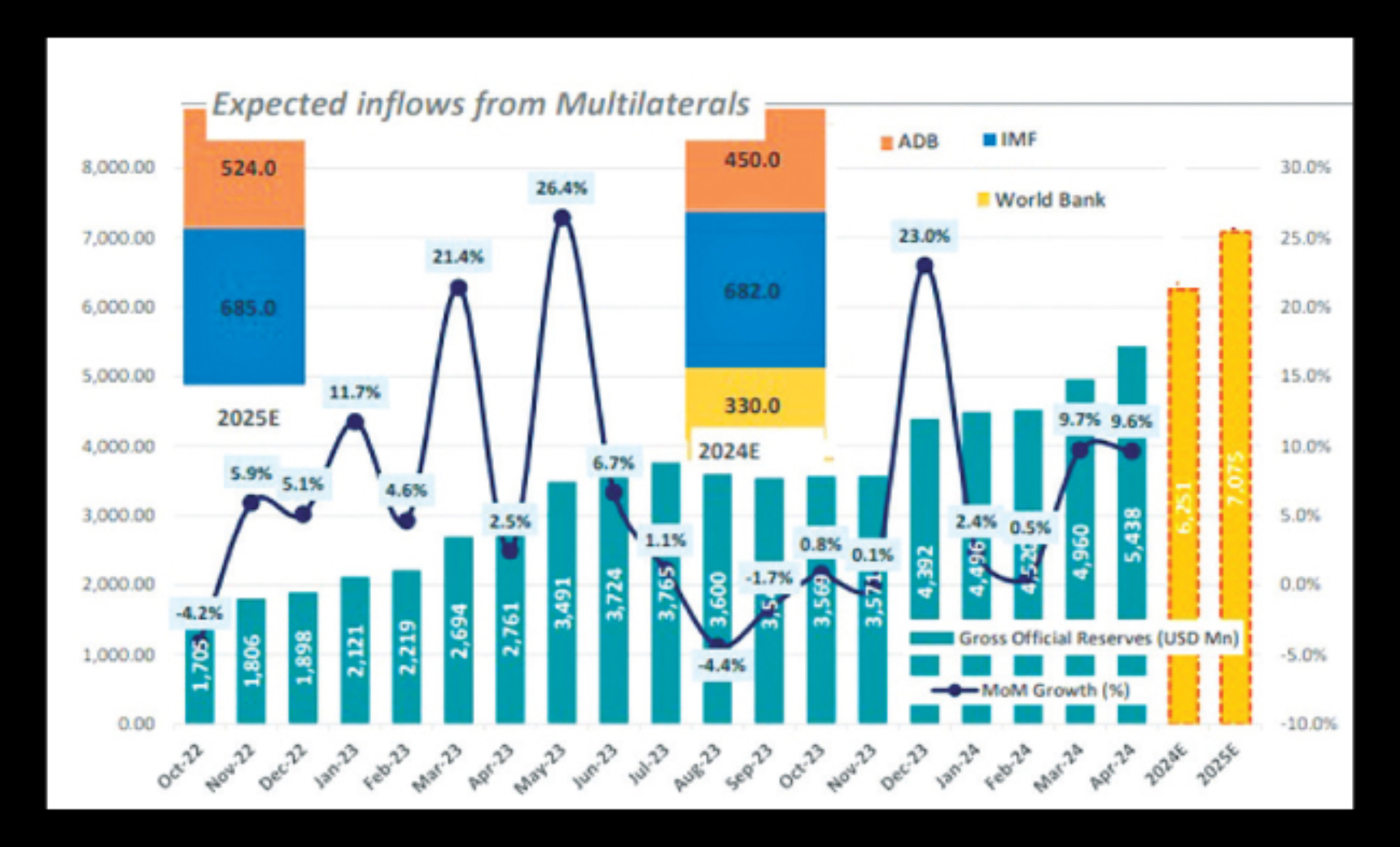

According to First Capital Research’s latest report, official reserves experienced a notable 23% increase in December 2023, boosted by disbursements from the IMF, World Bank, and ADB. This surge propelled reserves to USD 4.4 billion by year-end, reaching a three and a half-year high of USD 5.4 billion by April 2024.

The Central Bank’s continued dollar purchases since September 2023, coupled with a record-high purchase of USD 715.0 million in March 2024, have led to a significant appreciation of the rupee in 2024. Additionally, tourism earnings are forecasted to flourish, with projections indicating a potential increase to USD 3 billion by the end of 2024, surpassing the USD 2.1 billion earned in 2023.

The tourism sector is poised for a resurgence in 2024, as airlines and cruise tourism operations resume activities and promotional campaigns attract travelers to Sri Lanka. This anticipated growth in tourist arrivals and earnings has the potential to bolster the local currency, support a favorable current account balance, and attract foreign investment, contributing to economic expansion.

With projections indicating a surge in tourist arrivals exceeding 2 million and targeted earnings of USD 3 billion in 2024, Sri Lanka’s outlook remains optimistic. This anticipated growth is expected to enhance inflows, potentially mitigating any pressures of currency depreciation and positioning the country as an attractive destination for investments amidst a stable rupee.