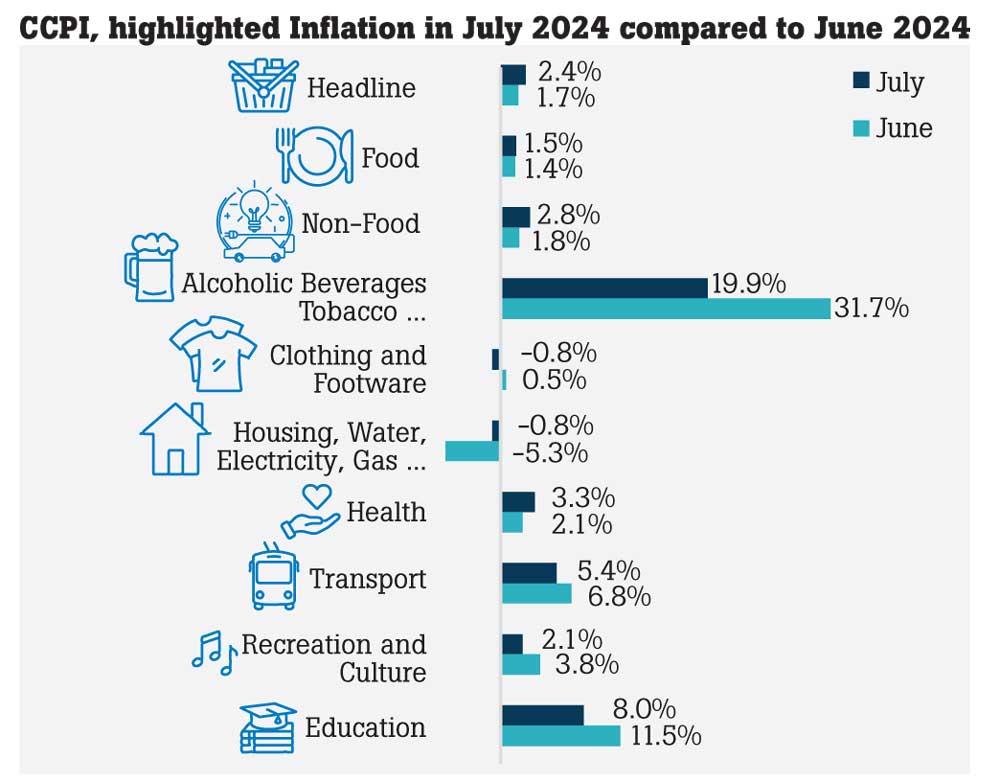

Sri Lanka’s consumer prices in the capital Colombo increased by 2.4% in the 12 months to July 2024. However, the central bank’s deflationary policy, which began impacting the balance of payments in September 2022, has only resulted in a 2.8% rise over the past 22 months.

In July, the Colombo Consumer Price Index (CPI) fell by 0.5 points to 194.7, bringing it slightly below the level observed in December 2023.

The central bank has maintained exchange rate stability while accumulating reserves and reducing domestic assets to support its deflationary stance. Recent volatility in the exchange rate emerged following excess liquidity from dollar purchases in June.

The food and non-alcoholic beverage sub-index increased by 0.1% in July, a slowdown compared to the 2.8% rise in June. Conversely, the housing and electricity index declined by 1.5% to 142.9 points.

Exchange rate stability has positively impacted the Ceylon Electricity Board, enabling it to reduce rates. Additionally, global coal prices have eased due to tighter U.S. policies, and oil prices have stabilized or decreased despite OPEC’s efforts to cut production.

In contrast, many countries supported by the International Monetary Fund have experienced currency depreciation due to conflicts arising from flexible inflation targeting or crawling pegs. This situation has led to social unrest as food and energy prices have risen.